Monday, May 30, 2011

Sunday, May 29, 2011

Stolen Italian Art Found in Kentucky (of all places)

This 14th century altarpiece was stolen from a villa in Italy in 1971 and sold to the Speed Art Museum in Louisville, KY in 1973. It is going to be returned to its rightful owner, the Italian authorities. I may have worked on this piece in a previous life in 14th century Italy when I went by the name of Frederico da Vidi. Sure looks a lot like the altarpiece I just built in the 21st century America.

Saturday, May 28, 2011

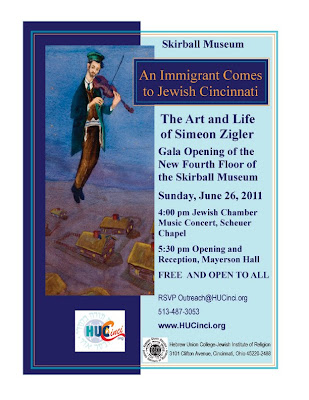

Up Coming Art Show: Opening June 26, 2011

I thought several of my friends and bloggers might be interested in knowing about this art show to commemorate my father's life and his artwork. There will be drawings, pen & India ink pieces from the 1930s, watercolor paintings from the late 1950s and 1960s. The show is free and open to the public. The Skirball Museum is on Clifton Avenue just north of the University of Cincinnati.

Tuesday, May 24, 2011

The Altarpiece: 5/24/2011

This is about as finished as it is going to get. The juried art show that I was going to submit this piece to came out with their square feet and weight limitations, and my piece is too heavy and too big. So, it was fun making this piece, but for now there is no show to enter. I guess I will find a wall somewhere to hang it. I will be making smaller altarpieces in the future. As I get older 30 pounds starts to feel more like 50 pounds.

THE ALTARPIECE: M&C: LPFOTW 43.5" x 31"(closed) 43.5" x 59" (open) wood and acrylic paint w/brass hinges, 2011. From the workshop of Frederico da Vidi.

Monday, May 16, 2011

The Altarpiece Doors: The Inside & reversed

I have been working on painting the inside of the 2 doors for the altarpiece. I think they need a little more work, but then I hope to be done with painting them. The are in the reverse positions in this photo as they will start with the sunflowers on the left and end with the winter view of the sunflowers and cone flowers on the right. Pretty soon it will be time to put the hinges back on the doors and then prepare the back of the case to be hanged on the wall.

Saturday, May 14, 2011

Saturday Is For Art: The Altarpiece Doors

The Altarpiece project is not finished, and I need to get back to finishing this piece. I gave the doors another coat of gold paint this morning. This week I need to work on the inside of the doors. We shall see if it is accepted in the Clifton Cultural Arts Center's juried Golden Ticket Art Show later this year. Will the judges consider the outside of the doors, the inside of the doors and large painting on the inside? Political satire doesn't win many friends where there is little or no humor. So, we shall see what happens later this year. I wonder if I should enter this piece under my Italian name as I was known in 15th century Italy? The Altarpiece: Mother & Child with Level Playing Field Out The Window from the workshop of Frederico da Vidi.

The doors: acrylic paint on birch covered plywood, 2011.

Friday, May 13, 2011

Old Legs And a Young Heart

The last piece of work I did today was my bike workout, and I missed the rain by just a few minutes. When I started the sun was shining, but early in my ride the clouds covered the sky and the air temperature dropped. Eventually the sky grew dark, but by then my workout was nearly complete. My legs burned, but after a while the burning went away. I try to keep spinning through the whole workout as they never go more than 45 minutes. I think my legs will get stronger with time as I hope to pedal at a good rate the 26 miles on June 12, 2011 for RIDE CINCINNATI. Sunday, if the weather cooperates, I am planning an easy ride down to the Ohio River parks and back.

Thursday, May 12, 2011

A Lot Less Petroleum Could Go A Long Way!

Today they announced that the produce price index is up 0.8% for April and that it was up 0.7% for the month before. Inflation is pretty easy to understand even if you are not an economist. When prices go up for products and services and those products and services are exactly the same now as they were just a short while ago, we say we have experienced inflation. Our dollars don't buy as much gasoline as they used to is just one example.

But, gasoline is a very important piece of our economy. Our economy to a very large extent runs on gasoline and diesel. So, when the price of gasoline and diesel goes up, every business that depends on gasoline or diesel must raise their prices if they are going to maintain their profit margins. Businesses that make no profits go bankrupt and close or else are sold to other companies that will find a way to make them profitable.

Fuel affects so much of our economy that it touches just about everything we produce or services we provide. Whether it is growing corn or delivering a package, fuel is a piece of the cost structure of that enterprise. In an earlier piece, I made mention of the fact that oil is priced in U.S. dollars, and that the United States imports and uses millions of barrels of oil each day. As oil prices rise, gasoline and diesel prices follow, and as these prices go up the products and services that depend on these fuels go up as well.

The answer to the problem is energy independence. When we can reduce the amount of oil we import, we can have a better balance between the amount of U.S. dollars leaving our domestic economy and the dollars that come back to buy products and services here. Too many dollars leaving and not enough coming back in to our domestic economy has the affect of reducing the demand for U.S. dollars and as a result of this, drives the price of oil by the barrel up in price.

It might sound too simple, but unfortunately, sometimes it is the simple things that are the hardest to fix. If the United States could reduce the amount of oil it imports every year, the U.S. dollar would get stronger. Alternative energy sources to supply our cars and trucks with fuel would change our domestic economic situation profoundly. The manufacture and use of electric vehicles could over the next decade have a significant affect, for the good, on our domestic economy and the U.S. dollar's strength in the world currency markets.

Stay tuned.

Wednesday, May 11, 2011

RIDE CINCINNATI JUNE 12, 2011: Getting in Shape

April was a washout for training, so I am going to have to get in shape in one month. I rode yesterday and felt pretty good afterwards, but I was not pushing myself. Today, I saw the sun shining and felt like riding so I put on my riding stuff and got on my bike and rode. I do short workouts during the week that last around 45 minutes, but I push myself the whole time. Sunshine, humidity and gravity make the muscles hurt, but the big pumper in my chest just keeps right on working. My legs get tired, but the pump just keeps pumping. Sunday, if the weather is cooperating, I will ride downtown to the parks along the Ohio River and then back to Northside. Tomorrow I will rest and give my old muscles a chance to recover a bit before I ride on Friday.

If you would like to find out more about RIDE CINCINNATI 2011, just Google it. This ride raises money to support breast cancer research here in Cincinnati. I believe this is the 5th year of the ride and I am looking forward to riding this year.

Saturday, May 7, 2011

S.I.F.A. 2 Drawings By Simeon Zigler

Here are 2 drawings that I recently had framed by the artist Simeon Zigler (1911-69). I thought they would be nice pieces for the up coming show of his paintings and drawings on Sunday, June 26, 2011 at 5 pm at the Skirball Museum on the HUC-JIR campus. This is Si first solo show of his art and in celebration of the gift he left and his 100th birthday. I hope you can come to the Opening.

Thursday, May 5, 2011

It is Time For Americans To Learn About Their Money

Now that gasoline is above $4 a gallon, I guess this is as good a time as any to talk about oil, the U.S. dollar and the price of gas.

Oil by the barrel is priced in U.S. dollars. Yes, I know oil can be priced in a basket of currencies or even just the Euro, but for the most part, oil is priced around the world in U.S. dollars. If those that sell oil believe that the purchasing power of the U.S. dollar is going down, and that the demand for oil will rise or remain the same, then the price of oil in U.S. dollars will go up. Some people that buy oil have no intention to ever take delivery of the barrels of oil they buy, and they are called speculators. They play the commodity oil for a possible pop in price and then sell their contracts when the price goes up. Speculation in oil like any other commodity can drive the price up or down depending on which way speculators believe the price of a particular commodity is going.

Because of the financial crisis and the economic recession that followed, our central bank the Fed has pursued a monetary policy of easy money, or more correctly they have helped banks with their problems of liquidity. Unfortunately, many banks made loans and gave credit and invested in mortgages that turned to shit. That means they were stuck with investments that had no marketability. The Fed decided to help keep these banks liquid by keeping the cost of borrowing reserves from the Fed low, or near nothing. The Fed also said they would buy the banks' shit loans and mortgages and help them out. These actions by the Fed inflated the currency, and while we haven't seen all aspects of this inflation in all products and services that does not mean inflation will not be a major problem in the future. While the housing market has seen prices decline, other markets have seen their prices rise. Precious metals such as gold and silver have seen their prices go up as people speculate that the U.S. dollar will fall in value, and as such lose its former purchasing power.

If people do not get a raise in their pay check and the purchasing power of the U.S. dollar declines, people have less money to spend even though they are receiving the same amount of dollars in their pay check. Then they have to spend $4 or more for a gallon of gasoline and they now have even less disposable income than they had when gasoline was selling for $2 a gallon. So, the amount of money you have is only a part of the equation. The important part of the equation is: how much can you buy in goods and services with the money you have?????

So, you now see that there is a connection between monetary policy and what your money will buy and how far it will go. For the last few years, I have written about the fact that monetary policy is made by the Fed for the benefit of the banks, and the banks are only part of the monetary system. We, the people are the other part of our monetary system and yet the 300 million of us that use our monetary system and its currency have no voice in how monetary policy is determined.

I believe in bank regulation by the federal government. I believe that the Glass-Steagal Act should have never been repealed. One of these days, when more people will understand money and banking, banks will be more regulated as they should be. Otherwise, we will have another financial crisis, and another economic recession, and the middle-class in the United States will become poorer and poorer as those helped by the Fed get richer and richer.

It is time for Americans to wake up and learn about their money.

Stay tuned.

Wednesday, May 4, 2011

Money: Much More Than A Medium of Exchange

One thing is almost certain, we all like money. Some of us would like to have so much money that money would not be something we worry about having enough of. Some people in the world have so much money that they don't worry about having enough money to pay for what they need or want. When you have more money than you need, you can invest your money. You can simply put it in a bank and earn interest, or, you can put it with an investment bank and have the money invested in an assortment of investments that will pay you interest, dividends and/or capital appreciation. Money in this form becomes a commodity. People can borrow your money and pay you interest, or, you can buy equity in a corporation and be paid dividends. But, for most of us money is a medium of exchange. If we want to buy food we use money. We don't take our widgets to the food store and exchange them for food. We need money to buy things. But, when we want to buy something very large and we don't have all the money to make the purchase, or, we don't have all the money on a particular date to buy something, we use credit. Credit is a form of money as it allows us to make a purchase when we don't have the money on hand at that moment. Buying a house or even a car might be a more common occasion to use credit. But, when we use credit, we are essentially renting money for a period of time. That rent is expressed as a percent, and we pay that rent over the life of the loan. When we buy a house, we may pay rent on the money we borrow for as long as 30 years. However, when we rent money to make a purchase on our credit card, we pay no rent if we pay the total sum of the money we borrowed at the end of the month. So, in this situation, we might think we are borrowing money for a month rent free.

Banks collect deposits from people that either have more money than they need to carry in their pockets, or people that choose not to carry money in their pockets, but would rather use credit cards or debit cards. Banks can lend a percent of the money deposited with them, but they are required to keep a small percent of that money as a reserve should people want to withdraw their money. If a bank runs short of reserves, the bank can borrow reserves from the Federal Reserve Bank, or, they can buy reserves from another bank that has free reserves. The Federal Reserve Bank can raise or lower the interest rate they charge the bank for these reserves. When the Fed wants to help the economy as it did in the last financial crisis, the Fed might make the cost of reserves for the banks near to nothing, 0% interest. The bank then can meet its reserve requirement and turn around and lend money at an interest rate above their cost of money. The difference between the interest rate that banks borrow money and lend money is called the spread. At one time, banks made their money on the spread between their cost of money and the rent they charged people for borrowing money from them. That was in the old days. Today banks can borrow at near nothing and invest in government notes and make money on the spread that way. Unfortunately, that form of lending does little to help the private sector of our economy.

People can bet with money too. No, I am not talking about going to a casino and betting your money. Since the world has several different currencies, all of them used as money, people with large pools of money can speculate which currencies might go up in value. If you take your U.S. dollars and exchange them for another currency and that exchange rate changes over a period of time, the move back into U.S. dollars may result in a capital appreciation. So, now we have made money by betting on the changing value of money. We can buy Euros or we can buy any currency we want. If you believe that holding your U.S. dollars is not a good thing to do, you can exchange your dollars for a currency of your choice in the hope of that currency going up in value so when you need your money in U.S. dollars you will not only have the amount you started with, but receive more dollars when you exchange your foreign currency back to U.S. dollars.

So, money can take on many forms. It is important to understand that money is not only a medium of exchange for buying things. Money is a commodity that people can rent for a period of time at a rate of interest. But, more than that money's value can change. Inflation is a word that we use to express the fact that prices have gone up and that it takes more money to buy a product or service than it did a period ago. That period may be just a matter of minutes or a matter of years. But, until we all understand what money is and what it can become, the Federal Reserve Bank and the commercial banks will dictate monetary policy in the United States. We, all of us, are part of our monetary system as we all use money, but we need to change the way monetary policy is made in the United States. And, before that happens, everyone will have to understand a lot more about their money. Money is much more than just a medium of exchange.

Stay tuned.

Tuesday, May 3, 2011

Pakistan: A Complicated Situation & Western Logic

The country of Pakistan is a complicated situation for the United States and the rest of the West. In this part of the world, things are not always so clean cut. Not everyone wearing a friendly uniform is on your side. In our western logic we say, it isn't black and white. No, everything in the world is not black or white, but it would be nice if life was that simple. When two teams line up on the field, one team is in one color and the opposing team is wearing a different color, and players can tell in a split second who is on their team and who is an opponent. But, that is the way things are in a controlled game where everyone agrees to the rules. The Pakistanis have not agreed to any rules, and obviously they don't play by our rules.

So, Why do we need them? The answer is quite simple. Pakistan is a nuclear power, and as such we need them on our side. They might not be on our side for everything, but we can live with that so long as they are on our side when it comes to their nukes.

So, perhaps now is it time to adopt the Pakistani logic of the situation. Osama bin Laden is dead; time to move on.

P.S. Later this week, I might try to write a piece about money and the various forms money takes. Water can be found in 3 states - a solid, frozen water we call ice, a gas, we call steam, and as a liquid which we call water. I might try to explain how water and money have properties in common.

Stay tuned.

Monday, May 2, 2011

Osama bin Laden is Dead: Shot in the Head

The moral of the Osama bin Laden story is: If you want something done right, do it yourself. The United States first tried to work with other governments in our pursuit of Osama bin Laden, but that did not work. Pakistan while they say they are our friend compromised our efforts. The bottom line of our success in finally killing Osama bin Laden is that we told no one of our plans and we carried them out with our own people. Had we done that years ago, we may have been successful then. But, for all those countries and people around the world that think we are soft, a paper tiger, let them chew on this USA success for a while. USA! USA! USA!!!

Subscribe to:

Posts (Atom)