With so much in the news about Iraq, the Presidential

candidates, the debates and the veto today by Pres.

Bush, a short piece in the news about Chavez

nationalizing the the oil industry in Venezuela goes

almost unnoticed. The production of crude from the

Venezuela oil fields is down because they lack the

skilled people to get the oil out. Unless the Saudis

increase their production, we may well see $4 a gallon

gas before the end of the summer. This will hurt our

economy, and it will hurt those who can least afford

higher gas prices. If you are watching prices when

you shop, you will notice that the higher costs of

fuel are resulting in higher prices across the board.

If ever we needed a bright idea, now is the time.

Energy costs will suck a lot of buying power right out

of our domestic economy. Unfortunately, this is going

to hit those families that can least afford a price

increase of basic necessities.

The above paragraph I wrote to someone I had worked with in the investment business when I worked for the State of Ohio. It was an e-mail dated May 1, 2007.

When I was a teenager back in the late 1950’s, I would take a bus to my Dad’s hardware store to spend time with him, and after I got my driver’s license, to be able to drive him home after we closed the store at 6pm. I remember my father commenting to me as he pointed to all the cars on Interstate I-75 that had only one occupant in the car, that some day America would be sorry for having wasted so much money to move one person in a big car from one place to the next. Naturally, having just got my driver’s license and enjoying the freedom that that driver’s license brought me, I thought my Dad was a bit over the top with his appraisal of the current situation. That was 50 years ago. Today, his words make a lot more sense to me than they did then. We did waste a lot of energy, gas, moving one person from one place to the next in a big inefficient gas guzzling car in the 1950’s. In fact, we continue to do that right to this day.

We, here in the United States, get upset and even angry about a lot of things that do not directly affect our economic well being, but America’s love affair with the car and the freedom to just pick up and go when you feel like getting out of the house or apartment is something that is part of each one of us that has experienced the joy of just taking a drive. We have not demanded better of ourselves in our use of energy, because we have not made it an important issue.

Now that we have made everyone’s business our business and spread ourselves too thin, those that helped to addict us to cheap gas have slowly let those economic forces coming from around the world, as well as our own addiction, tighten around our collective economic necks. We have been our own worst enemy when it comes to energy conservation.

It does not take an Einstein to realize what effect $4 a gallon gas would have on the United States’ economy. Any sudden increase in the price of any commodity used throughout the economy would produce like results. Gasoline and diesel move people and produce and manufactured products every day and their sudden price increase would have to mean a price increase in everything that is transported. This country has run on cheap inexpensive energy for generations. In the past the price increases that resulted in inflation were simply monetized as price levels simply ratcheted upward and wages eventually followed. What was a first-class stamp selling for in 1958 and what is it selling for today?

The big difference this time is that there are more countries in the world that are using more and more gas and diesel. This may be the time when the United States can no longer monetize the debt without having to pay a price. That price may come in the form of a longer and deeper recession. With all the other economic problems that the United States is dealing with right now, the price of gas may be one of the easier ones to fix. Gas prices and the other drags on the economy have made the inelastic demand for gas much more elastic this time around. As a result, the slow growth rate of the economy will be with us as seen in the recent movement of our stock markets downward. This recession will most likely last more than two consecutive quarters unless oil prices fall or the dollar gets stronger. There are only two ways oil prices can fall. One is if the production of oil is increased, or two, the demand falls off and the price of oil retreats. If Iraq pumps their oil night and day to take advantage of world wide demand, perhaps supply can over take demand and the price of oil can come down. But that is a big if.

The lack of leadership in the United States at this point in our history is historic. Are there no more leaders left to lead this once great country out of its economic plight? Stay tuned.

Monday, June 30, 2008

Saturday, June 28, 2008

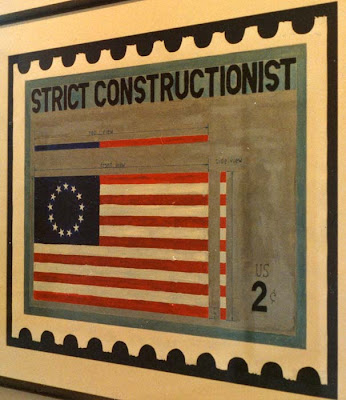

Saturday Is For Art

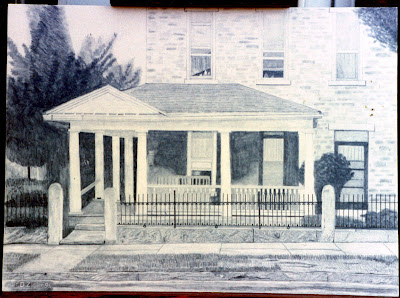

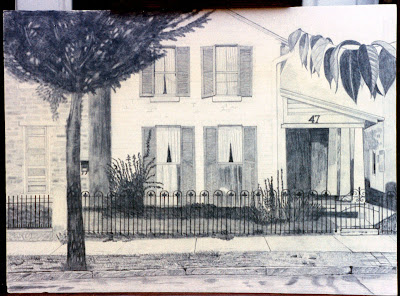

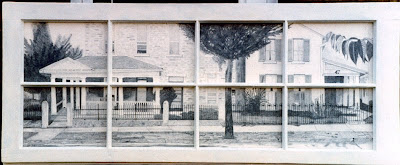

This week I am posting some pencil drawings that I then placed in old wood window frames. I don't know why I like to use old odd shaped wood window frames to frame my art, but for some reason I do. First, they are free and free frames are nice when you don't have much money to throw around. In fact, even when I had the money, I still liked using old wood frames when I found something that excited me enough to do a project with that frame. The first piece I drew in 1995. The houses are in downtown Dayton, Ohio on a street in the Oregon District where I parked my car for a number of years when I worked at a couple of banks in Dayton. The Oregon District is a historical district with lots of neat old homes. My idea behind this piece was to first photograph the houses and then do a pencil drawing so that when placed in the wood window frame and hung on the wall, it would look like the viewer was looking out of this window at two houses across the street. The drawing was an exercise in using a wide range of pencils with some very soft black lead and some with a harder lighter finish. The drawing is done on foam core board with a drawing surface on one side. The paperboards were cut to fit the frame with some minor woodworking so that two boards measuring 16 inches high by 22 inches wide could fit nicely in the frame.

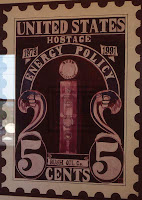

I always liked to draw with a pencil from the time I was a little boy, but when I was a teenager, I did not think I drew well enough to pursue art. As a result of that feeling about my ability, I went in another direction. The last drawing is also framed in an old odd shaped wood window frame that came from the apartment building I lived in while I worked in Columbus, Ohio. I titled this piece My Icons. I finished this drawing in 2007.

Friday, June 27, 2008

Deer In The Headlights?

How much can we talk about the price of oil? At some point, we have to start wondering what it will take before we see some leadership from the White House. We have all heard of a lame duck president, but have you ever heard of a dumb duck president?

Oil is now trading above $140 a barrel, and yet nothing encouraging or constructive is coming from our leaders. It is just like the corporation that has been run into the ground by a bad CEO. I am amazed that no one is not doing more to explore more ways to meet this oil crisis.

Now Libya is saying they want to reduce production because they believe the United States is interfering with OPEC. Hell, I wish our country would do something about the grip OPEC has on our economy right now. But, the situation is like a deer in the headlights, no movement just waiting to get run over by our inability to respond.

Inflation plays a big part in the way oil is priced today. The move by investors around the world to commodities as a hedge against the erosion of purchasing power of the US dollar continues to play out. The once strong and secure US dollar is not being perceived as strong as it once was. As for the security of the US dollar, we still are the country to be in. Regardless of all the problems we are facing, the United States is the country to be. When we see a change in the direction of immigration, then we will have something to really be worrying about. The economy of the United States will come through this cycle. The only question is how much damage to the American family will be absorbed by this change in the price of oil. People will out of necessity have to rearrange their buying habits.

The stimulus checks are not going to be enough to pay for gas for even a summer. Stay tuned.

Afternoon Comments: Comments On The Fed's Actions in March 2008

The Fed did the right thing by stepping in and arranging the sale of Bear Stearns to J.P. Morgan. In my opinion, the issue should not even be debated, that's how sure I am the Fed did the right thing. Unfortunately, the Democrats in Congress need to start out with Econ 101 before they find fault with Ben Bernanke and his staff for what they accomplished for the good of the whole nation's well being. Senator Chris Dodd did not know he was getting a special VIP rate on his mortgage from Countrywide, yet they, Congress, understands the effect a bankruptcy by the fifth largest investment bank on Wall Street would have had on our financial markets at home and around the world. Please, give me a break! I should apply for a Federal grant to teach economics to members of Congress. Bernanke prevented a disaster of such proportions that it would have made the oil crisis look like a non-event by comparison. This nation is fortunate that when it comes to the Chairman of our central bank, we appointed someone with the education to do the job, and do it well. Democrats in Congress and Republicans challenged by economics, Bernanke did one hell of a good job and it may be years before you all realize the pain and suffering that he avoided for his country.

Oil is now trading above $140 a barrel, and yet nothing encouraging or constructive is coming from our leaders. It is just like the corporation that has been run into the ground by a bad CEO. I am amazed that no one is not doing more to explore more ways to meet this oil crisis.

Now Libya is saying they want to reduce production because they believe the United States is interfering with OPEC. Hell, I wish our country would do something about the grip OPEC has on our economy right now. But, the situation is like a deer in the headlights, no movement just waiting to get run over by our inability to respond.

Inflation plays a big part in the way oil is priced today. The move by investors around the world to commodities as a hedge against the erosion of purchasing power of the US dollar continues to play out. The once strong and secure US dollar is not being perceived as strong as it once was. As for the security of the US dollar, we still are the country to be in. Regardless of all the problems we are facing, the United States is the country to be. When we see a change in the direction of immigration, then we will have something to really be worrying about. The economy of the United States will come through this cycle. The only question is how much damage to the American family will be absorbed by this change in the price of oil. People will out of necessity have to rearrange their buying habits.

The stimulus checks are not going to be enough to pay for gas for even a summer. Stay tuned.

Afternoon Comments: Comments On The Fed's Actions in March 2008

The Fed did the right thing by stepping in and arranging the sale of Bear Stearns to J.P. Morgan. In my opinion, the issue should not even be debated, that's how sure I am the Fed did the right thing. Unfortunately, the Democrats in Congress need to start out with Econ 101 before they find fault with Ben Bernanke and his staff for what they accomplished for the good of the whole nation's well being. Senator Chris Dodd did not know he was getting a special VIP rate on his mortgage from Countrywide, yet they, Congress, understands the effect a bankruptcy by the fifth largest investment bank on Wall Street would have had on our financial markets at home and around the world. Please, give me a break! I should apply for a Federal grant to teach economics to members of Congress. Bernanke prevented a disaster of such proportions that it would have made the oil crisis look like a non-event by comparison. This nation is fortunate that when it comes to the Chairman of our central bank, we appointed someone with the education to do the job, and do it well. Democrats in Congress and Republicans challenged by economics, Bernanke did one hell of a good job and it may be years before you all realize the pain and suffering that he avoided for his country.

Thursday, June 26, 2008

Fed Funds to Remain at 2% for Now

The big headlines to come out of the Federal Reserve Bank meeting is that “interest rate cutting is done.” After lowering the Fed funds rate seven consecutive times, the Fed is not lowering this key interest rate again. Despite the shaky condition of the economy, the Fed by their action to leave rates where they are is telling everyone that other considerations now must be weighed into the equation. With the price of gas going up rather suddenly and rising by more than one dollar within the period of one year, the Fed is concerned with the prospects of a new round of inflation.

The chairman of the Fed, Ben Bernanke, will now try to talk inflation expectations down. This may work, but a little help from the Bush administration could help too. What can the Bush administration do? The first thing the Bush administration could do is start behaving like they are concerned about people that are not making over $150,000 a year. Second, close down the Enron loop hole in the rules for commodity trading in the United States. This one act would take some of the speculation out of the oil trading business. Repair relations with oil producing countries and see if there is anything we could do for them. Talk to the American people about using less oil. Make people feel like it will take a little from all of us to get through this current energy crisis. Unfortunately, I do not see any of those ideas being implemented, as this is one of the most incompetent presidents this country has had in over 200 years. The country is more than ready for new leadership.

The chairman of the Fed, Ben Bernanke, will now try to talk inflation expectations down. This may work, but a little help from the Bush administration could help too. What can the Bush administration do? The first thing the Bush administration could do is start behaving like they are concerned about people that are not making over $150,000 a year. Second, close down the Enron loop hole in the rules for commodity trading in the United States. This one act would take some of the speculation out of the oil trading business. Repair relations with oil producing countries and see if there is anything we could do for them. Talk to the American people about using less oil. Make people feel like it will take a little from all of us to get through this current energy crisis. Unfortunately, I do not see any of those ideas being implemented, as this is one of the most incompetent presidents this country has had in over 200 years. The country is more than ready for new leadership.

Wednesday, June 25, 2008

Truth, Justice and The American Way

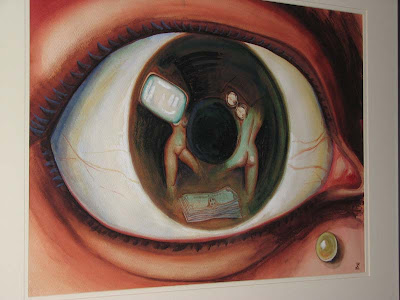

I love TV because I grew up with it. TV to me is like an art form that has changed over the years to attract a bigger and bigger audience. There is nothing wrong with that as networks like CNN and MSNBC and others can not stay in business if they are not making a profit. If their programing gets too intellectual, they will lose viewer ship, and viewer ship makes their world go round. Many years ago, when I was a young boy, my father had my brothers and I watch a program on Sunday afternoons called Omnibus with Alistair Cooke. Omnibus’ programing was too intellectual and eventually disappeared from the airwaves.

Today, I was watching a lady on CNN explain that the Fed was charged with two responsibilities and that they were trying to keep them in balance. The first was to keep the economy growing and the second to keep inflation down. Simple enough you might think, but if you have been reading moneythoughts just once in a while, you know that nothing in economics is that simple, especially in an economy as complex as ours in the United States.

Our Federal government has a big hand in the direction our economy is going and where our taxes are being spent. Money spent here within the United States to repair and improve the infrastructure does different things for the economy than money spent on a “war” in Iraq. Money spent on subsidies has a different effect than money spent on research and development for alternative energy sources by universities and private research organizations.

Several factors have taken our economy to where it is today. Monetary policy is just one of many factors and perhaps it is not one of the primary factors as this economic story evolves in 2008. Oil, diesel and gasoline and their sudden sharp price increase has taken the lead role in this economic drama over the last two years.

No one wants to talk about the historical significance of oil in our economy and the role it has played since the end of World War II. Talking might lead to thinking and we can not have Americans thinking. Thinking people vote, and they know the difference between the BS issues designed to sidetrack them from the issues that affect their wallet, and the issues that directly affect their economic well being.

The United States, though perhaps criticized around the world from time to time, is known as the economic engine of this planet. When the engine is in trouble the train does not move. Other engines depend on our engine to help pull their train. The cost of oil is having an affect not only in the United States, but around the world. When people rise up and protest, the politicians will get the message. Not many politicians have ever had anything to do with drilling for oil or natural gas. If we could run the country on their hot air, we might be energy independent, but that is only in cartoons.

So, the Fed wants to keep inflation down and at the same time keep the economy growing. No one wants a recession. The key ingredient in this economic equation is oil, and the Fed has no hand in that. This is a job for Superman! Where is Clark Kent when we need him? Truth, justice and the American way are under fire. We need a Super Hero to get us through this, where is he? Will the real leader of the free world please stand up! Stay tuned.

Today, I was watching a lady on CNN explain that the Fed was charged with two responsibilities and that they were trying to keep them in balance. The first was to keep the economy growing and the second to keep inflation down. Simple enough you might think, but if you have been reading moneythoughts just once in a while, you know that nothing in economics is that simple, especially in an economy as complex as ours in the United States.

Our Federal government has a big hand in the direction our economy is going and where our taxes are being spent. Money spent here within the United States to repair and improve the infrastructure does different things for the economy than money spent on a “war” in Iraq. Money spent on subsidies has a different effect than money spent on research and development for alternative energy sources by universities and private research organizations.

Several factors have taken our economy to where it is today. Monetary policy is just one of many factors and perhaps it is not one of the primary factors as this economic story evolves in 2008. Oil, diesel and gasoline and their sudden sharp price increase has taken the lead role in this economic drama over the last two years.

No one wants to talk about the historical significance of oil in our economy and the role it has played since the end of World War II. Talking might lead to thinking and we can not have Americans thinking. Thinking people vote, and they know the difference between the BS issues designed to sidetrack them from the issues that affect their wallet, and the issues that directly affect their economic well being.

The United States, though perhaps criticized around the world from time to time, is known as the economic engine of this planet. When the engine is in trouble the train does not move. Other engines depend on our engine to help pull their train. The cost of oil is having an affect not only in the United States, but around the world. When people rise up and protest, the politicians will get the message. Not many politicians have ever had anything to do with drilling for oil or natural gas. If we could run the country on their hot air, we might be energy independent, but that is only in cartoons.

So, the Fed wants to keep inflation down and at the same time keep the economy growing. No one wants a recession. The key ingredient in this economic equation is oil, and the Fed has no hand in that. This is a job for Superman! Where is Clark Kent when we need him? Truth, justice and the American way are under fire. We need a Super Hero to get us through this, where is he? Will the real leader of the free world please stand up! Stay tuned.

Tuesday, June 24, 2008

The Fed Meets Today

Today our central bank, The Federal Reserve Bank, is having a meeting and everyone around the world is watching, waiting and trying to anticipate what is going to take place at that meeting. Regardless of what the Fed decides to do, there are going to be side effects because the “patient”, our economy, is suffering from several economic and political ailments. When thinking about our economy and the Fed, think patient and doctor. Then realize that like so many medications prescribed by the doctor, there are side effects. In some cases the side effects are almost as bad as the problem itself.

First up is inflation, and the prospects of inflation accelerating is very real as energy prices continue to go up and up as they have over the last year to 18 months. The price of so many products have been affected by the increased fuel and energy costs. In Hawaii, where much of the food has to be transported into the islands, transportation costs have necessitated that retailers raise their prices to account for the increased cost of delivery to the islands. People can not just drink coffee and eat pineapples all day, children need a balanced diet. So, when the members of the Fed sit down today to have their meeting, they have to think about what fuel prices are doing to inflation. Normally, the way the Fed would slow the rate of inflation would be to raise interest rates. But, the economy is in a bit of a recession. President Bush does not think we are in a recession, and by a strict definition of a recession, we are not there yet. But, there has been several economic or market events that have taken place in the last year to year and a half that indicate that a recession is not far behind or out of the picture.

The American economy has experienced a credit crisis with huge ramifications for the growth of the economy. Many banks are facing loan losses from the slow down in the growth of the economy. The housing market is going through turbulent times and the sub-prime mortgage crisis has had a tremendous impact not only on the housing market, but because these mortgages were securitized into mortgage bonds, the holders of these sub-prime mortgage bonds are also a casualty of the economic crisis. Given all this and more that has not been mentioned here, the Fed would like to keep interest rates where they are, unchanged.

So, the trick is to keep interest rates down to help the economy through these difficult times, while at the same time hope that inflation will not rise too rapidly and cause further economic damage. And all this, without the federal government changing its spending habits. If we could in reality stop spending money overseas on so many different projects, like the “war” in Iraq, the government could spend those same dollars here at home in the United States rebuilding our infrastructure. That along with a movement, completely voluntary, to use less gas and buy less imported goods when possible would all help our economy. The second idea is probably impossible to do since so many items are no longer produced in the USA anymore.

Budgets of almost every American family have been impacted by the sudden increase in the cost of oil and the refined products of diesel and gasoline. We do not have lines at the gas station as there is plenty of gas. But, the sudden spike in the price of fuel has caused a dislocation in the national economy much the same way a stiff tax would do, except a stiff tax would pay down our budget deficit and at least push the US dollar up in value on the foreign currency exchanges around the world. But, we are not even getting that benefit because the price increase is actually causing the US dollar to further decline because we are importing so much oil.

Economically, the United States’ economy is in a box. Politically, the United States is in a presidential election year with just a few more months before the November election. Either way, not much is going to happen until there is a new president and a new congress. My fellow Americans, for the next few months, many of us are going to be in for some tough times. For some of us this is going to feel like war. In truth, we are in the midst of an economic war and one of the weapons is oil and while we can get as much gasoline as we want, that is not the question. The question is how much can we afford. This is the time for those of us that want to survive, to go into survival mode. Many already have, and many more of us will follow before this economic war is over. There are things that the government can do to easy the pain. Let us hope that some new measures might be taken to reduce the problems that the political- economy has caused for so many of us. Stay Tuned.

First up is inflation, and the prospects of inflation accelerating is very real as energy prices continue to go up and up as they have over the last year to 18 months. The price of so many products have been affected by the increased fuel and energy costs. In Hawaii, where much of the food has to be transported into the islands, transportation costs have necessitated that retailers raise their prices to account for the increased cost of delivery to the islands. People can not just drink coffee and eat pineapples all day, children need a balanced diet. So, when the members of the Fed sit down today to have their meeting, they have to think about what fuel prices are doing to inflation. Normally, the way the Fed would slow the rate of inflation would be to raise interest rates. But, the economy is in a bit of a recession. President Bush does not think we are in a recession, and by a strict definition of a recession, we are not there yet. But, there has been several economic or market events that have taken place in the last year to year and a half that indicate that a recession is not far behind or out of the picture.

The American economy has experienced a credit crisis with huge ramifications for the growth of the economy. Many banks are facing loan losses from the slow down in the growth of the economy. The housing market is going through turbulent times and the sub-prime mortgage crisis has had a tremendous impact not only on the housing market, but because these mortgages were securitized into mortgage bonds, the holders of these sub-prime mortgage bonds are also a casualty of the economic crisis. Given all this and more that has not been mentioned here, the Fed would like to keep interest rates where they are, unchanged.

So, the trick is to keep interest rates down to help the economy through these difficult times, while at the same time hope that inflation will not rise too rapidly and cause further economic damage. And all this, without the federal government changing its spending habits. If we could in reality stop spending money overseas on so many different projects, like the “war” in Iraq, the government could spend those same dollars here at home in the United States rebuilding our infrastructure. That along with a movement, completely voluntary, to use less gas and buy less imported goods when possible would all help our economy. The second idea is probably impossible to do since so many items are no longer produced in the USA anymore.

Budgets of almost every American family have been impacted by the sudden increase in the cost of oil and the refined products of diesel and gasoline. We do not have lines at the gas station as there is plenty of gas. But, the sudden spike in the price of fuel has caused a dislocation in the national economy much the same way a stiff tax would do, except a stiff tax would pay down our budget deficit and at least push the US dollar up in value on the foreign currency exchanges around the world. But, we are not even getting that benefit because the price increase is actually causing the US dollar to further decline because we are importing so much oil.

Economically, the United States’ economy is in a box. Politically, the United States is in a presidential election year with just a few more months before the November election. Either way, not much is going to happen until there is a new president and a new congress. My fellow Americans, for the next few months, many of us are going to be in for some tough times. For some of us this is going to feel like war. In truth, we are in the midst of an economic war and one of the weapons is oil and while we can get as much gasoline as we want, that is not the question. The question is how much can we afford. This is the time for those of us that want to survive, to go into survival mode. Many already have, and many more of us will follow before this economic war is over. There are things that the government can do to easy the pain. Let us hope that some new measures might be taken to reduce the problems that the political- economy has caused for so many of us. Stay Tuned.

Monday, June 23, 2008

Oil Can Make You Think

Monday morning, a new week. This past weekend there was a meeting of oil producing nations and oil consuming nations. The Saudis who have the capacity to pump more oil said they would raise their production a modest 200,000 barrels a day. Many realize that this amount will hardly change the supply demand equation in the world of oil consumption. Prices will remain in the $135 a barrel range and higher range. The Saudis blamed the problem on speculators and that is indeed part of the problem. While the United States government can not cut off all speculation, we can close the loop holes here in our own commodity markets. But, oil is a weapon as its importance to the economies around the world needs little if any proof. The clash of ideologies with the way societies are run in the Middle East, where much of the oil is produced, and the way societies in the rest of the world are constructed and the freedoms enjoyed there, can not be discounted when examining the situation that much of the non-oil producing world finds themselves. To think that this is pure economics is a big mistake in my opinion. The Saudis would like are attention as it relates to our ideas as to how the world should be constructed, as opposed to their ideas on how their society should be constructed. Going back to 1967, the time of the Six Day War, when Israel defeated their enemies in a period of six days, I remember at that time listening to Arab delegates from Middle Eastern countries speaking at the United Nations. They were talking about their societies and their culture, a culture that was more advanced than the west during Europe’s Middle Ages. When Europe was living in darkness, they had street lights in some cities in the Middle East. I specifically remember one delegate telling his audience, as I listened over the radio, that they did not have to eat American hot dogs to be civilized. So, here we are 41 years later, with our hat in our hand pleading for more oil production. If our society with all its do’s and don’ts is so much superior to theirs, then why are we all so dependent on their oil? Certainly a country that has existed for well over 200 years as a republic, that has fought in two world wars and has risen to be one of the most powerful nations on the planet, should understand the place oil plays in the smooth operation of its economy. Where was our superior planning? The Saudis are not a loud people, or at least the rulers of the kingdom are reserved in their comments. When you have as much oil and wealth as the Saudis have you do not have to raise your voice to be heard, others will lower their voices to hear you. This past weekend the world listened and the Saudi’s oil minister spoke. He did not have to raise his voice to be heard because people wanted to hear what he had to say. The Saudis would like us to listen to other things they are saying and not saying. In other words, as we in the west would say, if you have all the answers about how a society should be constructed, if you know all the laws that mankind should follow, and have the temerity to believe everyone else on the planet should follow your laws, your ideologies, your philosophy of life, then why have you not done a better job of preparing yourselves for the future that is now? One does not have to eat hot dogs to be civilized. I can not help but think that the Saudis are, through their calculated actions, asking the West to stretch their minds a little. Perhaps the world is big enough for several ways of life and they all need not include the eating of hot dogs. Before we come around telling them how to live, how to run their society, perhaps we should do a better job of looking after our own. If the West is so perfect, then why do we find ourselves in the situation we are in with regards to our shortage of oil. The first oil embargo took place 35 years ago, where was our planning since then? Eventually, the West will figure out a substitute for oil, but that is years away. In the meantime, we are getting a quiet lesson in how not to be a big know-it-all. We are being told in a very subtle way, while we think the societies and philosophies of the Middle East need to be modernized, our societies in the west do not have all the answers either. If we did, we would not have been working last weekend and asking Saudi Arabia to pump more oil.

New subject. Today is the opening day of the 19th Annual Pension and Financial Services Conference being held in Philadelphia, PA by the National Association of Security Professionals (NASP). Membership in NASP is made up of minorities and women, two groups that historically were excluded from Wall Street and the professions involved in the securities and money management business. Today, some of the best money management companies and brokerage and investment banking firms are owned and operated by minorities and women. When I worked for the State of Ohio, I had the opportunity to meet, work and get to know many of these outstanding investment professionals. They are a very bright and talented group that have given trustees around the country and the world a reason to look beyond the major money management groups when it comes to money management expertise. The three-day conference gives their members a chance to network and share ideas and help educate pension trustees to the fact that there are some excellent money managers and investment banking firms among minorities and women. Here is wishing all my old friends another successful NASP Conference!

New subject. Today is the opening day of the 19th Annual Pension and Financial Services Conference being held in Philadelphia, PA by the National Association of Security Professionals (NASP). Membership in NASP is made up of minorities and women, two groups that historically were excluded from Wall Street and the professions involved in the securities and money management business. Today, some of the best money management companies and brokerage and investment banking firms are owned and operated by minorities and women. When I worked for the State of Ohio, I had the opportunity to meet, work and get to know many of these outstanding investment professionals. They are a very bright and talented group that have given trustees around the country and the world a reason to look beyond the major money management groups when it comes to money management expertise. The three-day conference gives their members a chance to network and share ideas and help educate pension trustees to the fact that there are some excellent money managers and investment banking firms among minorities and women. Here is wishing all my old friends another successful NASP Conference!

Saturday, June 21, 2008

Saturday Is For Art

This paper mache' sculpture is a fish. When I lived in Columbus, Ohio, I had a pet gold fish that was an Oranda. These gold fish are fancy and have these bumps, known as a wen, on their head. Some time before or after my friend Mr. Oranda died, I started on a paper mache' fish. You see, I had all these old Wall Street Journals laying around my apartment in Columbus, so I decided to make something with them. I started out with using wire coat hangers and scraps of metal screening and then I covered this armature with newspaper. As there was no rush to complete this project, Mr. Oranda was a project in the making for several years. Whenever I felt like doing some paper mache', Mr. Oranda grew in size. After I got him to where I thought I wanted him, I covered him with several coats of gesso. Then I decided to "bronze" him with burnt umber. The three photos of Mr. Oranda is my piece of art for this Saturday.

This paper mache' sculpture is a fish. When I lived in Columbus, Ohio, I had a pet gold fish that was an Oranda. These gold fish are fancy and have these bumps, known as a wen, on their head. Some time before or after my friend Mr. Oranda died, I started on a paper mache' fish. You see, I had all these old Wall Street Journals laying around my apartment in Columbus, so I decided to make something with them. I started out with using wire coat hangers and scraps of metal screening and then I covered this armature with newspaper. As there was no rush to complete this project, Mr. Oranda was a project in the making for several years. Whenever I felt like doing some paper mache', Mr. Oranda grew in size. After I got him to where I thought I wanted him, I covered him with several coats of gesso. Then I decided to "bronze" him with burnt umber. The three photos of Mr. Oranda is my piece of art for this Saturday.Mr. Oranda kept me company for many years while I lived and worked in Columbus during the week. He provided me with an outlet to work with my hands during the week as my work shop was back at my home in Cincinnati. Those were some interesting years that I lived in Columbus and worked for the State of Ohio. Mr. Oranda and I have been working on a book about my life in the investment business and those years in Columbus. The working title of the book is: Investments, Politics & Race: A View From The Inside. If I am lucky enough to find a publisher, I will certainly let everyone know.

Friday, June 20, 2008

FFF: Friday Full of Frustration

The idea that less regulation is better is being tested today in the United States. In the newspapers and on the TV are reports that people are being prosecuted for losing money in hedge funds, while others are facing prosecution for their role in the mortgage meltdown. The former chairman of our central bank, Alan Greenspan, was known for his attitude towards regulation. He came from the political-economic philosophy that less regulation was better and no regulation was best. Unfortunately, the recent experience we have all observed with regards to hedge fund managers and mortgage brokers, demonstrates that less regulation is not better. I know the arguments against regulation, that it is an unnecessary expense thrown on the backs of business. This is a lame reason. What has it cost all of us that regulation was not enforced, or that proper regulation was thwarted by groups that lobbied against more or better regulation. How do we assess the cost to our economy for the lack of adequate regulation in our recent past? Does anyone think that the abuses we have seen in the securities and mortgage businesses are less costly to us as a nation than what has happened to our economy now? Even our food supply and imported children’s toys needs better regulation as to the quality and fitness of the products that we let into our country. The idea that corporations will do the right thing is a myth. Corporations pay homage to one deity and that is the bottom line. To give you a visual, corporations if given half a chance, are like an 18-wheeler truck blasting through stop signs with no regard for anyone’s safety except their own profitability. They have the size, financial and political muscle to push their agenda all the way to the Congress of the United States. Measure how much we are spending now to prosecute those that broke the law. Could not this money been better spent on regulation, oversight and auditing? It is not enough that we are running a trade and budget deficit, but that the confidence in our investment banking institutions, our commercial banks, our mortgage businesses and the housing market all are now suspect every day. The greed of a few has extracted a heavy price from all of us. Add to all of these factors our situation with the price of oil and the decline of the value of the US dollar, and you have a society and an economy that is being put to the test of its resourcefulness and durability. This country has many many good and decent people. Most of these people had little if anything to do with the crisis that hit us in 2007 and 2008. Some have even referred to the situation in the United States today as the privatization of profits and the socialization of losses. For many of us, it certainly feels that way. The sale of Bear Stearns to J.P. Morgan that was arranged with the approval and concessions by the Fed are now being examined more closely. I still feel the Fed did the right thing for the good of everyone, not just for J.P. Morgan or Bear Stearns. But the people need to know that some actions will be taken by the Fed and the other government parties involved in the sale, that such an occurrence is not likely to happen again. At least not in the near future, and at best, never. But this all gets back to the American electorate raising the level of discourse and not letting themselves be side tracked by wedge issues that only act to draw their attention from the things that really need to be fixed by new regulation, proper oversight and auditing. Joe six pack, please wake up, your country that you thought you knew and loved is being taken away from you. Bad tomatoes are for throwing at bad politicians, not feeding to our children. Lead paint should not be on children's toys either. Treating every American, citizen or not, decently is what we used to be all about. That is the level playing field that we all strive for. It is time to put on the spikes and get out there and make it happen. We must makes change now. Stay tuned.

Thursday, June 19, 2008

Is This War?

Understanding a little about economics, to my mind, is pivotal to the long term stability of our republic. It is the electorate that must raise the level of discourse in a democracy in the 21st century. Politicians will jockey for position so long as they believe that the electorate can be manipulated by dogma, rhetoric and sound bites. And, the politicians will continue to pursue this strategy until the electorate proves that it no longer works.

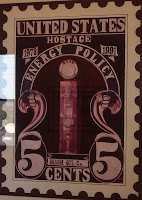

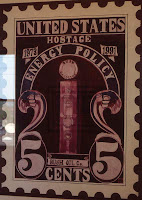

The history of the energy policy in the United States since the end of the Second World War is an excellent study of how politics made a difficult situation, our need for energy independence, much worse.

At the end of the Second World War, the large shipping companies that had been carrying oil for the Allies during the war, took their track records as carriers of oil to the banks in New York city and borrowed money to build larger and then ever larger tankers to transport oil from the Middle East to the United States. The importance of oil to win the war does not even have to be debated. It is a given. Had Nazi Germany secured the sources of oil for their war effort, the out come of the Second World War would have been quite different. Oil as far back as the beginning of the World War was known as a commodity that could determine not only victory in a war, but the survival of a country. Where were the long term planners in the United States at this time? During the Eisenhower administration, the great Interstate Highways that run through our nation east and west, north and south, were begun. Economists knew that the country would grow in population as the baby boomers were arriving every seven seconds across the country. With the increase in traffic, consumption of oil and the products made from oil would also rise. And yet, more and more of our supply of oil came from areas of the world that were much less stable than our own. And, for years, 1945-73, there were no serious problems obtaining that supply of oil.

By 1973, at the time of the first oil embargo, to the creation of OPEC, our nation did little if anything to protect its people from dependency upon imported oil. In fact, laws were passed to suppress our development of new oil sources and refinery capacity here in the United States. Today, we find ourselves at the mercy of producing nations that would like nothing better than see the United States brought down a peg or two. We, through our lack of leadership, have become our own worst enemy. We can blame OPEC and Saudi Arabia for not increasing oil production in the face of an ever growing world wide demand, but in truth, we need to look at ourselves. We have failed to protect "the pipeline" that oil is to our economy.

There is a great deal of suffering going on across this great nation, but there will not be any quick fixes despite the sound bites that we hear on the news. Americans are going to put intellectual pressure on their elected officials by voting out those that can not see the pain and suffering that is occurring across this nation. Blaming the Saudis or the Chinese or for that matter anyone else, but ourselves for the position we find ourselves in today is nothing more than scape goating the problem. Every country has a duty to look out for the well being of their people. We can not expect others nations to look out for us.

Now the big oil companies are going back to Iraq after 36 years of not being in Iraq to sign oil contracts with the Ministry of Interior. So much for saving the world for democracy.

A change in our energy policy will not produce immediate results as far as the price of gas is concerned, but it would send a strong signal to the rest of the world that we in the United States are serious about taking responsibility for the future of our energy needs. In essence, this is war. We must secure that oil "pipeline" for our own survival. The days when we thought that importing oil was no more than a tanker logistical problem are over. Stay tuned

Wednesday, June 18, 2008

We Really Do Not Have Many Options

The single best economic idea to be broadcast recently came from a presidential candidate that has admitted that he does not know a lot about economics. Perhaps that fact alone should tell us something about economics. It ain’t rocket science.

Senator John McCain’s suggestion that the United States Congress reverse direction and permit oil and natural gas drilling and exploration along our own coastline is the best idea even though the effects of such a change in policy may be years away. Like a person badly over weight taking that first step to change their ways and pursue a healthier life style, so too the United States needs to take that first step.

For the last 35 years, since the oil embargo of 1973, the United States government has had its collective head in the sand when it came to a comprehensive energy policy, a policy that would ultimately lead to complete and independent control of our energy needs. But, because politicians in the United States are not held accountable by the people that elect them, little if any progress towards energy independence has been achieved.

A good case can be constructed that we get the government we deserve. Some Americans are happy if they have a drink in their hand and the TV on, while others have no interest at all in what is going on with the economy or public policy. Too few Americans take an interest in what goes on in the area of national economic policy. If you have a pretty face and you have a nice voice, and you run for office enough times, chances are you will eventually get elected. Unfortunately, for the people that are represented, a knowledge of economics is not required. What we are seeing in the United States today are those chickens coming home to roost. As I read one economist put it, the Federal Reserve Bank is in a box. I suggested as much several times in previous postings.

The situation is that interest rates are as low as the Federal Reserve Bank wants to go because of their fear of helping to be responsible for more inflation. With commodity prices running wild around the world, the Fed realizes that to lower key interest rates at this point would only help to fan inflationary pressures. On the other hand, the Fed realizes that our domestic economy is in a very fragile state as a result of our credit crisis, our mortgage problems and the fall off in our housing market. There are many people saying and thinking that the United States is not doing well. Our stock markets and their recent fall is evidence of the problems the economy faces.

But that is where the analogy to a single person ends. The economic life of a country as big as the United States does not just rolls over and dies. What we need to do is attack the one area that can turn our economic future around. Much needs to be done to protect the consumer from businesses that cross over the double-yellow line and present horrendous problems for the rest of us like the credit crisis, the sub-prime mortgage mess or the unregulated greed of hedge funds. The idea that an economy as large as the United States’ economy can be successful for the long term without adequate regulation is just plain stupid in my opinion. Even on our Interstate Highways, I see people driving in the emergency lanes and doing everything they can to circumvent the rules of safe driving. Wall Street is no different, rules need to be enforced and the country needs to adequately fund regulation and enforcement of our security laws. These problems, while not directly tied to the energy problem, has hurt the economy and limited our avenues of recovery.

If we as a nation were dealing with one crisis, the price of oil, our options would be a lot different. For the umpteenth time, the United States must reduce its dependency on foreign oil. Given the amount of imports the United States brings in, and not just from China, and the amount of oil we import, the balance between imports and exports is too far out of line. Add to that the budget deficit the United States is running as a result of our invasion of Iraq and other questionable spending programs spelled pork, and we find ourselves in a very difficult economic situation.

But, we need to start somewhere and the place to start, in my opinion, is for the United States to change our drilling and exploration policy as it applies to our own coast. We need to get control of our own energy needs. This will not necessarily lower the price of oil, but every barrel of oil produced in the United States, is one less barrel of oil that needs to be imported. We are not going to turn this ship of state around on a dime, but we must take that first step. With oil prices where they are today, the continued development of alternative energy sources will remain competitive and should be encouraged by the government.

This shift in our policy of oil and natural gas drilling and exploration is an announcement to the rest of the world that we get it. We, the people of the United States, now realize that we must take responsibility for our own energy needs. We would never out source our need for our defense to the Chinese, so why do we let OPEC have such an influence over our needs for energy?

As I said at the beginning, this isn’t rocket science. Sometimes the best ideas are the most simple and apparent. Our economy can not wait until next year and a new administration. There are no time-outs when it comes to our economy. The clock is running and we need to take action now. I sincerely hope that our Congress with reverse itself and permit the exploration and drilling along our coasts. We need to control the sources of the energy we need and use and begin reducing our dependency on foreign oil. Stay tuned.

Senator John McCain’s suggestion that the United States Congress reverse direction and permit oil and natural gas drilling and exploration along our own coastline is the best idea even though the effects of such a change in policy may be years away. Like a person badly over weight taking that first step to change their ways and pursue a healthier life style, so too the United States needs to take that first step.

For the last 35 years, since the oil embargo of 1973, the United States government has had its collective head in the sand when it came to a comprehensive energy policy, a policy that would ultimately lead to complete and independent control of our energy needs. But, because politicians in the United States are not held accountable by the people that elect them, little if any progress towards energy independence has been achieved.

A good case can be constructed that we get the government we deserve. Some Americans are happy if they have a drink in their hand and the TV on, while others have no interest at all in what is going on with the economy or public policy. Too few Americans take an interest in what goes on in the area of national economic policy. If you have a pretty face and you have a nice voice, and you run for office enough times, chances are you will eventually get elected. Unfortunately, for the people that are represented, a knowledge of economics is not required. What we are seeing in the United States today are those chickens coming home to roost. As I read one economist put it, the Federal Reserve Bank is in a box. I suggested as much several times in previous postings.

The situation is that interest rates are as low as the Federal Reserve Bank wants to go because of their fear of helping to be responsible for more inflation. With commodity prices running wild around the world, the Fed realizes that to lower key interest rates at this point would only help to fan inflationary pressures. On the other hand, the Fed realizes that our domestic economy is in a very fragile state as a result of our credit crisis, our mortgage problems and the fall off in our housing market. There are many people saying and thinking that the United States is not doing well. Our stock markets and their recent fall is evidence of the problems the economy faces.

But that is where the analogy to a single person ends. The economic life of a country as big as the United States does not just rolls over and dies. What we need to do is attack the one area that can turn our economic future around. Much needs to be done to protect the consumer from businesses that cross over the double-yellow line and present horrendous problems for the rest of us like the credit crisis, the sub-prime mortgage mess or the unregulated greed of hedge funds. The idea that an economy as large as the United States’ economy can be successful for the long term without adequate regulation is just plain stupid in my opinion. Even on our Interstate Highways, I see people driving in the emergency lanes and doing everything they can to circumvent the rules of safe driving. Wall Street is no different, rules need to be enforced and the country needs to adequately fund regulation and enforcement of our security laws. These problems, while not directly tied to the energy problem, has hurt the economy and limited our avenues of recovery.

If we as a nation were dealing with one crisis, the price of oil, our options would be a lot different. For the umpteenth time, the United States must reduce its dependency on foreign oil. Given the amount of imports the United States brings in, and not just from China, and the amount of oil we import, the balance between imports and exports is too far out of line. Add to that the budget deficit the United States is running as a result of our invasion of Iraq and other questionable spending programs spelled pork, and we find ourselves in a very difficult economic situation.

But, we need to start somewhere and the place to start, in my opinion, is for the United States to change our drilling and exploration policy as it applies to our own coast. We need to get control of our own energy needs. This will not necessarily lower the price of oil, but every barrel of oil produced in the United States, is one less barrel of oil that needs to be imported. We are not going to turn this ship of state around on a dime, but we must take that first step. With oil prices where they are today, the continued development of alternative energy sources will remain competitive and should be encouraged by the government.

This shift in our policy of oil and natural gas drilling and exploration is an announcement to the rest of the world that we get it. We, the people of the United States, now realize that we must take responsibility for our own energy needs. We would never out source our need for our defense to the Chinese, so why do we let OPEC have such an influence over our needs for energy?

As I said at the beginning, this isn’t rocket science. Sometimes the best ideas are the most simple and apparent. Our economy can not wait until next year and a new administration. There are no time-outs when it comes to our economy. The clock is running and we need to take action now. I sincerely hope that our Congress with reverse itself and permit the exploration and drilling along our coasts. We need to control the sources of the energy we need and use and begin reducing our dependency on foreign oil. Stay tuned.

Tuesday, June 17, 2008

An Ugly Word Rears Its Head: Stagflation (2008)

First, I would like to thank those reading MONEYTHOUGHTS, as of this morning we reached our 4,000th visitor. I probably accounted for about half those visits because I often return to read my own stuff. After giving it a rest for a few minutes, I come back and reread to make sure the English is correct. I never leave a posting without going over it at least twice.

Second, I would like to thank all my readers from India and other countries that read MONEYTHOUGHTS. I know there are many well written blogs and I appreciate all those who stop by. There are many viewpoints as to what is taking place in the United States today and with the economy. This blog is just one of many, but it is not in New York City nor is it in Washington, D.C. Here, you get my opinion, as I see national and world events unfold through my eyes living in Cincinnati, Ohio. There are certainly much more sophisticated and deeper analysis's of the economic events that are taking place in the world today; however, I try my best to keep it simple. Here in the Midwest we sometimes refer to this as KISS --”keep it simple stupid.”

And third, the purpose of MONEYTHOUGHTS is not to drive a particular political agenda. People need to understand what is happening to their money as well as how government policies effect their money. When enough people sit up and take an interest in how their money is being devalued by inflation, a more level playing field will occur. There are many many issues on the table and money is just one of them, but a very important one. In our economy in the United States, credit, savings and investing all revolve around money. As we have noted before, our money in the United States is made up of Federal Reserve Notes. The Fed is our central bank and as such, has tremendous power over what happens to our money. If our Fed raises interest rates, they can slow the growth of the money supply and in turn the economy. The Fed can also buy US Treasury securities in the open market and inject more money into the economy to facilitate growth. The Fed was created by Congress, and answers to Congress several times a year about the state of the economy. The monetary policies adopted by the Fed have a direct bearing on what happens to the purchasing power of your money. Without purchasing power, your money is worthless. Worthless money is not money as the purpose of money is to make the exchange of goods and services efficient. Where there is no money, there is barter. In our global economy of today, barter is not an option. For us in the United States, our Federal Reserve Notes takes the place of barter.

An old word is starting to creep into our economic discussion here in the United States. It has been a good 30 years since the word stagflation was being knocked about in civil economic discussions. Stagflation is a compound word coming from the words stagnate and inflation. We all know what inflation is, but for purposes of review, inflation is when it takes $4 to buy a gallon of gas instead of $2. The gasoline is the same mixture and essentially it is identical to the $2 gasoline. Because the price has gone up and the product is the same at both prices, we say our money has lost purchasing power.

Commodities are a good vehicle to chart inflation as the item in question essential does not change. When we look at manufactured items such as a car, it is much more difficult to assess the effects of inflation. The car today is not the same car that was produced 30, 20 or even 10 years ago. Technological advances make a strict comparison impossible.

The stag part of stagflation refers to the fact that no economic growth is taking place in the economy. We in the United States experienced stagflation after the first oil embargo in 1973. The oil embargo was just one factor in the stagflation that occurred in the 1970’s. The Vietnam War caused the government to print a lot of money and this helped produce some of the price inflation that the United States experienced.

When the prices of raw materials rise rapidly, companies that provide a product or even a service, such as the airlines, can not maintain profitability without adjusting their prices upward to the consumer. The oil companies, like the airlines, pay more for the raw material from which they make gasoline and diesel, and must charge a higher price. The airlines are paying more for jet fuel and they too need to charge a higher price. If prices go up too rapidly, the consumer must make a choice as to whether they can afford or do without that product or service. A vacation using the airlines may become something people can choose to do without. Gasoline or diesel to get to work is a different story. This is why we say the demand for gas is more inelastic than the demand for airline tickets. We need to buy gas to get to work, we do not need to take a vacation on a jet plane.

When enough companies find their profits margins squeezed because of higher raw material costs and they can not pass them along to the consumer of those products or services, economic growth stops. In fact, if the situation persists, economic growth becomes a negative number and the economists say we are in a recession. If the no-growth lasts two consecutive quarters, then the economy is said to be in a recession.

When it comes to price changes, gradual is better and really slow price changes over several years is still better. Best would be no price changes, neither up or down, but that is never going to happen. Deflation can be as difficult for an economy to handle as rapid inflation. The whole premise for holding stocks is that under conditions of gradual, hopefully very gradual inflation, companies can pass along to the consumer a higher price and thus maintain their profit margins and profitability. Thus the corporation grows its earnings through more sales and a bigger profit margin. When corporations can not pass along their increased costs to the consumer, corporation down size, cut employment, postpone construction projects and try to hang on. When enough corporations are facing this reality, the economy is in big trouble and the stock market is just one indication of our lack of economic growth. This situation coupled with inflation is know as stagflation, and stagflation is not a very pretty picture. Stay tuned.

Second, I would like to thank all my readers from India and other countries that read MONEYTHOUGHTS. I know there are many well written blogs and I appreciate all those who stop by. There are many viewpoints as to what is taking place in the United States today and with the economy. This blog is just one of many, but it is not in New York City nor is it in Washington, D.C. Here, you get my opinion, as I see national and world events unfold through my eyes living in Cincinnati, Ohio. There are certainly much more sophisticated and deeper analysis's of the economic events that are taking place in the world today; however, I try my best to keep it simple. Here in the Midwest we sometimes refer to this as KISS --”keep it simple stupid.”

And third, the purpose of MONEYTHOUGHTS is not to drive a particular political agenda. People need to understand what is happening to their money as well as how government policies effect their money. When enough people sit up and take an interest in how their money is being devalued by inflation, a more level playing field will occur. There are many many issues on the table and money is just one of them, but a very important one. In our economy in the United States, credit, savings and investing all revolve around money. As we have noted before, our money in the United States is made up of Federal Reserve Notes. The Fed is our central bank and as such, has tremendous power over what happens to our money. If our Fed raises interest rates, they can slow the growth of the money supply and in turn the economy. The Fed can also buy US Treasury securities in the open market and inject more money into the economy to facilitate growth. The Fed was created by Congress, and answers to Congress several times a year about the state of the economy. The monetary policies adopted by the Fed have a direct bearing on what happens to the purchasing power of your money. Without purchasing power, your money is worthless. Worthless money is not money as the purpose of money is to make the exchange of goods and services efficient. Where there is no money, there is barter. In our global economy of today, barter is not an option. For us in the United States, our Federal Reserve Notes takes the place of barter.

An old word is starting to creep into our economic discussion here in the United States. It has been a good 30 years since the word stagflation was being knocked about in civil economic discussions. Stagflation is a compound word coming from the words stagnate and inflation. We all know what inflation is, but for purposes of review, inflation is when it takes $4 to buy a gallon of gas instead of $2. The gasoline is the same mixture and essentially it is identical to the $2 gasoline. Because the price has gone up and the product is the same at both prices, we say our money has lost purchasing power.

Commodities are a good vehicle to chart inflation as the item in question essential does not change. When we look at manufactured items such as a car, it is much more difficult to assess the effects of inflation. The car today is not the same car that was produced 30, 20 or even 10 years ago. Technological advances make a strict comparison impossible.

The stag part of stagflation refers to the fact that no economic growth is taking place in the economy. We in the United States experienced stagflation after the first oil embargo in 1973. The oil embargo was just one factor in the stagflation that occurred in the 1970’s. The Vietnam War caused the government to print a lot of money and this helped produce some of the price inflation that the United States experienced.

When the prices of raw materials rise rapidly, companies that provide a product or even a service, such as the airlines, can not maintain profitability without adjusting their prices upward to the consumer. The oil companies, like the airlines, pay more for the raw material from which they make gasoline and diesel, and must charge a higher price. The airlines are paying more for jet fuel and they too need to charge a higher price. If prices go up too rapidly, the consumer must make a choice as to whether they can afford or do without that product or service. A vacation using the airlines may become something people can choose to do without. Gasoline or diesel to get to work is a different story. This is why we say the demand for gas is more inelastic than the demand for airline tickets. We need to buy gas to get to work, we do not need to take a vacation on a jet plane.

When enough companies find their profits margins squeezed because of higher raw material costs and they can not pass them along to the consumer of those products or services, economic growth stops. In fact, if the situation persists, economic growth becomes a negative number and the economists say we are in a recession. If the no-growth lasts two consecutive quarters, then the economy is said to be in a recession.

When it comes to price changes, gradual is better and really slow price changes over several years is still better. Best would be no price changes, neither up or down, but that is never going to happen. Deflation can be as difficult for an economy to handle as rapid inflation. The whole premise for holding stocks is that under conditions of gradual, hopefully very gradual inflation, companies can pass along to the consumer a higher price and thus maintain their profit margins and profitability. Thus the corporation grows its earnings through more sales and a bigger profit margin. When corporations can not pass along their increased costs to the consumer, corporation down size, cut employment, postpone construction projects and try to hang on. When enough corporations are facing this reality, the economy is in big trouble and the stock market is just one indication of our lack of economic growth. This situation coupled with inflation is know as stagflation, and stagflation is not a very pretty picture. Stay tuned.

Monday, June 16, 2008

The Oil or US Dollar Predicament

This morning a barrel of oil traded near $140. Traders and analysts have stated that the continued weakness of the US dollar is the primary reason for the continued increase in the price of oil. That may be the case, but the high price for a barrel of oil has caught the attention of Saudi Arabia. The Saudis are concerned about this not because the high price has put a strain on the world’s economy and the price of food production as well, but because if the price of oil stays high, the Saudis believe that alternative sources of energy will be pursued.

We, the United States, should have had a Manhattan Type Project going right after the first oil embargo in 1973. But, why didn’t we? That, my friends and fellow Americans is the billion dollar question. Actually, it is the several billions of dollar question. In previous writings, I have mentioned that it is my opinion, after doing a little reading over the last 40 some years, that the recycled petrodollars that runs Washington, D. C is the major reason no Manhattan Type Project has been pursued. I still hold that view and by a process of logic, anyone with an average brain and a little curiosity, would come to that same conclusion.

What can the United States do about the falling dollar? Well, if we had a balanced trade policy, meaning that if we exported an amount in US dollars roughly equal to the US dollars we spend on imports, we could buy up some of our currency on the open market. But, that option is out for us now because we are not anywhere near a balance with our import/exports. In the language of the traders, doing such a thing is like "trying to catch a falling knife." It is not a very good idea. So, since we can not buy dollars on the open market, we need to look at another avenue to pursue.

What about drilling and pumping for more oil in and around the United States? Perhaps, if the rest of the world saw that we were serious about solving our energy problem spelled oil, we would see the dollar stop falling. Everyone in the world now knows that investors around the world are buying commodities, such as oil, as a hedge against a falling US dollar.

Why do investors around the world think the US dollar is going to continue to fall in value? I can answer that question in two words, monetize debt. The United States government in cooperation with the Federal Reserve Bank monetizes the debt of the US Government. In other words, our government, besides running a trade deficit and a budget deficit, is also expanding the money supply at a rate that is making our Federal Reserve Notes worth less and less when we go out and buy things like gas. If you put your money in a bank and you are not earning any interest on your deposit, you are losing money. How are you losing money if you are not spending it? Take the price of a gallon of gas and chart the increase in price over the last 18 months, and then figure how many fewer gallons of gas you can buy now than you could buy 18 months ago for the same $100 bill. Now, perhaps everyone can understand what is happening to those Federal Reserve Notes we get when we go to the bank for some cash.

This is not rocket science or brain surgery. This is just plain economics, and very basic economics at that. Too much money chasing a limited supply of a commodity, any commodity in demand will do, and the price of the commodity must go up. Unless there are price controls or rationing of gasoline, the price must go up. The cost of the raw material from which gasoline is made has gone up and continues to go up. That is why investors are continuing to buy oil as a hedge against a US dollar declining in purchasing power.

If as many people were interested in their money, trade and budget deficits, monetary policy as it is practiced in the United States, as watched American Idol every week, the US government would be forced to live within its means. People would riot if they understood what was happening to their money. I guess we are all lucky that is not the case. Ignorance is bliss.

In a chess match, this is where the opponent says “check”, as in “check mate”, only it isn’t “check mate” yet. We still have time to work our way out of this predicament. I just wish someone would say or do something that would indicate that there is a light on somewhere among our leaders. Stay Tuned.

Saturday, June 14, 2008

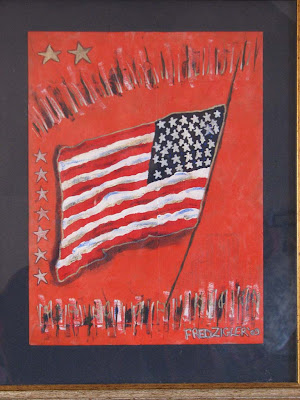

Saturday Is For Art: My Dad's Watercolors For Father's Day 2008

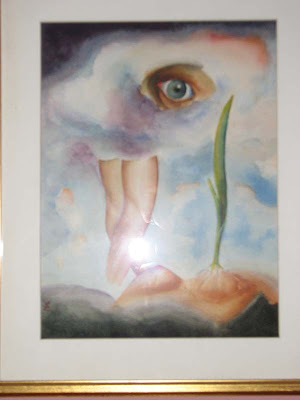

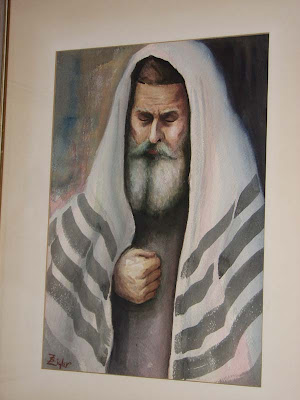

Simeon S. Zigler 1911-69 Mature Pupil, watercolor, late 1950's

Mature Pupil, watercolor, late 1950's

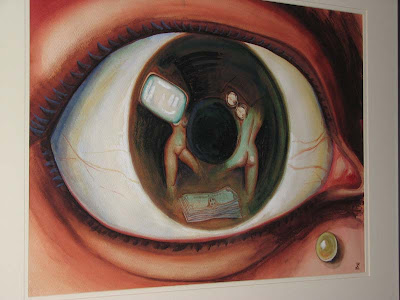

JUSTICE, early 1960's

JUSTICE, early 1960's

Untitled, late 1960's

Untitled, late 1960's

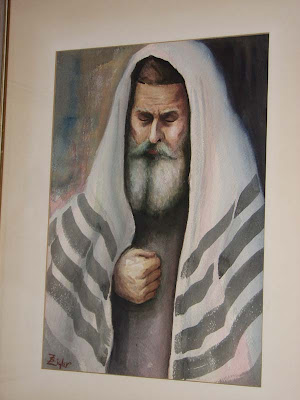

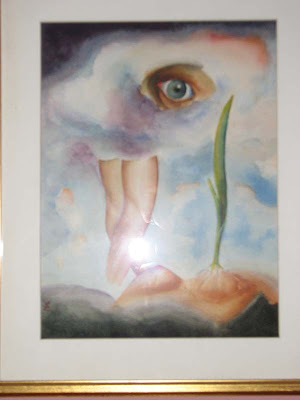

PRAYING, 1960's

PRAYING, 1960's

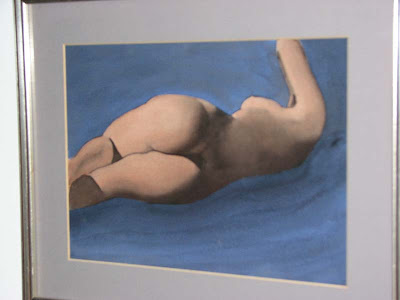

Reclining Nude

Reclining Nude

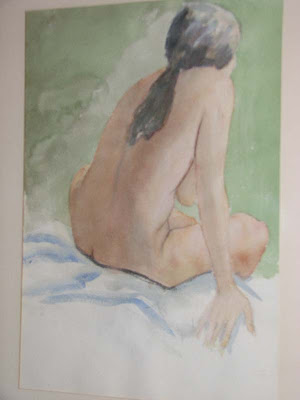

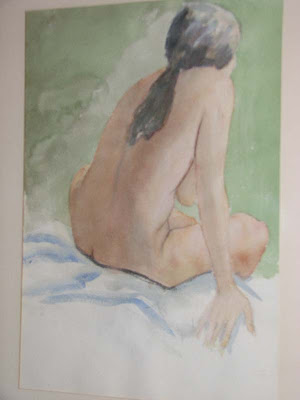

Sitting Nude

Sitting Nude

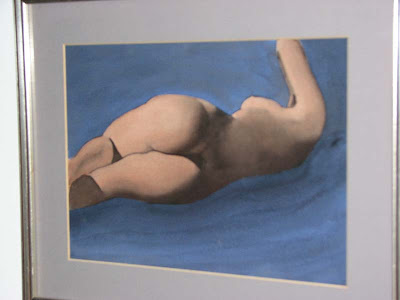

Blue Nude

Blue Nude

Here are seven watercolor paintings that were painted by my father. The dates of the paints range from the late 1950's to the late 1960's. In the mid-1950's, my father took up watercolor and starting painting again. As a teenager he had attended night classes at the Cincinnati Art Academy in the late 1920's. He left the field of art during the Great Depression and did not return to painting until the mid-1950's. However, he kept his "eye" and hand moving by doing sketches in his hardware store when he was not busy. One customer of the hardware store would bring my Dad his old PLAYBOY magazines to look at and read. My dad would draw the skeleton of the nude in ballpoint pen over the photographs of the nudes as a way to work on his knowledge of the human anatomy. He joined the Cincinnati Art Club in the early 1960's and was a regular at the Thursday Night Sketch Group. He really enjoyed that night out of the house and sharing and learning from the other men in the club. The above nudes are from those sketch group sessions which he would later work on at home. I apologize for the hot spots on the photos, I took the photos just this morning and needed the extra light of the flash. I thought you all would enjoy getting to see a real artist, my Dad.

Mature Pupil, watercolor, late 1950's

Mature Pupil, watercolor, late 1950's JUSTICE, early 1960's

JUSTICE, early 1960's Untitled, late 1960's

Untitled, late 1960's PRAYING, 1960's

PRAYING, 1960's Reclining Nude

Reclining Nude Sitting Nude

Sitting Nude Blue Nude

Blue NudeHere are seven watercolor paintings that were painted by my father. The dates of the paints range from the late 1950's to the late 1960's. In the mid-1950's, my father took up watercolor and starting painting again. As a teenager he had attended night classes at the Cincinnati Art Academy in the late 1920's. He left the field of art during the Great Depression and did not return to painting until the mid-1950's. However, he kept his "eye" and hand moving by doing sketches in his hardware store when he was not busy. One customer of the hardware store would bring my Dad his old PLAYBOY magazines to look at and read. My dad would draw the skeleton of the nude in ballpoint pen over the photographs of the nudes as a way to work on his knowledge of the human anatomy. He joined the Cincinnati Art Club in the early 1960's and was a regular at the Thursday Night Sketch Group. He really enjoyed that night out of the house and sharing and learning from the other men in the club. The above nudes are from those sketch group sessions which he would later work on at home. I apologize for the hot spots on the photos, I took the photos just this morning and needed the extra light of the flash. I thought you all would enjoy getting to see a real artist, my Dad.

Friday, June 13, 2008

Pick A City?