Tonight, I will complete my seventh decade living in America, and I have seen and been a part of its history. The inauguration of President Obama in January of this year was a most remarkable thing when you consider our history and the story of full civil rights for black Americans. That the Republican Party does not want a Democrat in the White house to score any points is nothing new. America's history is filled with examples of political fighting between the parties. But, this time it is different. At least for this historian it is different. Let me explain.

In the summer of 1964, after graduating from the University of Cincinnati with a bachelor's degree in American History, I decided to hitch hike to New Orleans. There I got a job on a Norwegian freighter and took a cruise to Venezuela, Columbia and the Dominican Republic. After my cruise, I tried to get a job on an American freighter, but the economy was slow in the summer of 1964, so I hitch hiked to Atlantic City. In Atlantic City I found a job developing black & white film for United Press International (UPI) in the basement of the Democratic National Convention.

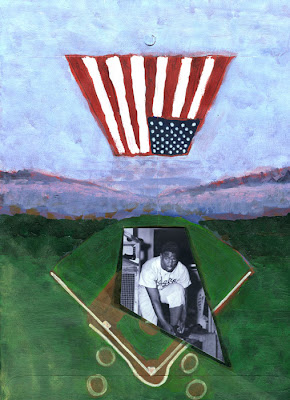

Up stairs on the convention floor was a woman by the name of Fannie Lou Hamer. She was from Sunflower County, Mississippi and she was black. In 1964, the Democratic delegation to the convention was all white and anti-civil rights. But, this was about to change. Fannie Lou Hamer was a member of the Mississippi Freedom Democratic Party, also know as "Freedom Democrats". As Vice-Chair of this delegation Fannie Lou Hamer pressed her case to be seated as part of the Democratic delegation from Mississippi. They won two seats to the consternation of President Johnson. This cost the Democrats the South for many years as Nixon's Southern Strategy opportunistically took advantage of the racial hatred that manifested itself during the Civil Rights movement.

While I was developing black & white film in the basement, Fannie Lou Hamer was making black & white history on the convention floor. She died on March 14, 1977 in Mound Bayou, Mississippi many years before she could see our country elect its first black president. But, she is not forgotten by those of us who where there in the summer 1964 and remember her words, "I am sick and tired of being sick and tired."

So, knowing the American History that I lived through and the battles that were fought for racial equality in America, I am not surprised by the attacks on President Obama. President Obama, Fannie Lou Hamer had it a lot worse.

Stay tuned.