I get up and get out of bed on the same side every morning, but for some reason I feel like I got out on the wrong side this morning. Perhaps it is all the stuff I have been reading lately that makes me realize that very little if anything is going to change with regards to the way business people influence the way business is conducted in Washington. I am not a pessimistic person by nature, so let me explain.

Yesterday I received an e-mail from a lawyer friend of mine with an article attached from The New York Times dated April 29. The title of the article, Dealbook: Junk Bonds, Mortgages and Milken by Andrew Sorkin is a nice short article and to the point. Basically, the article opens with the assertion by one "super lawyer" from a large New York law firm that Michael R. Milken, godfather of junk bonds, is responsible for the present credit crisis and sub-prime mortgage mess. That is just plain nonsense. But the article goes on to quote Milken at a recent conference that he holds in Beverly Hills where he discusses the economy and finance.

Milken is originally from California and makes his home in LA. I have read about him over the years in newspapers, magazines and even a book titled Predator’s Ball. In my humble opinion, Milken is the real deal. If you want to know more about him, just Google Michael R. Milken and start reading.

He is the inventor of the junk bond or as they are also known -- high yield bonds. Before Milken, Wall Street would only underwrite a corporation if it could get a Baa (by Moody) or a BBB (by Standard & Poors) on its corporate debt. No one would bring a new issue of corporate bonds to market with less than a Baa/BBB rating. Now after a corporate bond issue was priced and traded in the bond market for a few years, things could happen. If the corporation was mismanaged or would run into hard times, and its ability to pay principal and interest came into question, then the rating agencies might lower the rating on the entire issue of corporate debt. These bonds then became known as fallen angels. Milken made a study of these fallen angels and found that over the years, perhaps two percent of fallen angels never paid off, meaning that they were a total loss. But, the other 98 percent, despite being downgraded by the rating agencies did pay off, and the investor received the full principal and interest at maturity. With this knowledge Milken realized that corporate debt could be used like equity to get start ups financed. Thus the emergence of the high yield bond and what is referred to as the junk bond market. Junk Bonds played a role, but like anything else, the purpose could be abused. In some cases there was abuse and high yield bonds got a bad name.

In the conference in Beverly Hills, Milken is quoted as saying, “the question is whether the future will be like the past.” Knowing how business has been conducted in Washington in the past, I am not too optimistic that there will be real change as it pertains to regulation, oversight and auditing on Wall Street in the future. The world of finance requires knowledge and to make the necessary changes requires knowledge as well. The politicians don’t have the knowledge, nor are they going to take the time to learn what they need to know to make the right changes. Knowledgeable people from Wall Street will fill their collective heads with what Wall Street wants them to know and no more. We have been down this road before. Not too many years ago there were changes made to the laws regarding Savings & Loans, also known as Savings Banks. They at one time invested solely in mortgages. But Congress changed the laws, and permitted them to invest in other things besides mortgages, like junk bonds. Did you guess that? In other words, asking if things in the future are going to be different is like asking will dandelions grow in the fields this spring. Some things just don’t change, and Washington is one of them.

Back a few weeks ago, when the Fed stepped in and facilitated the sale of Bear Stearns to JP Morgan Chase, I received a comment from one of my readers that my opinion that the Fed had done the right thing was spoken like a true banker. Now, several weeks later, looking back and looking forward at what the situation is, I am beginning to wonder myself, just what did the Fed facilitate. I was more concerned with the innocent people that would have been affected than anything else. The families and lives that would have been disrupted and the unnecessary suffering that such a financial disaster would have created were foremost in my mind. Now that the winds have calmed down and all the greedy bastards on Wall Street have come out of their hole, I am having second thoughts.

There are several good people out there in the world of finance that know what needs to be done to curb abuse. This is a big country and among the experienced hands on Wall Street present and retired, there is an abundance of talent that could be harnessed to draw up the specs for a better system. The question that Milken should have asked, do we have the courage to make the future different. Stay tuned.

Wednesday, April 30, 2008

Tuesday, April 29, 2008

What is a Bubble?

Every profession has its own vocabulary and the field of finance and investment securities is no exception. Some words enlighten while others just sound good and do not really explain the events very well. Take the word bubble, what does bubble really mean. A bubble occurs when a market gets overpriced. Sometimes referred to as the greater fool theory. That is when someone will come along and pay a higher price for a product until there is no one left that will pay the higher price and then the price starts to come down, down, down. At that point the bubble is said to have burst. Is that what happened in the recent mortgage bubble or meltdown?

An article in this past Sunday’s New York Times Magazine titled Triple-A Failure: How Moody’s and other credit rating agencies licensed the abuses that created the housing bubble - and bust by Roger Lowenstein is excellently written and researched. Anyone that wants to examine a bubble under the microscope needs to read this article. Unfortunately, the people in Washington that represent the people, that should read this article every morning when they get up and every night before they lay down, will probably not read this article at all.

The bottom line is that the rating agencies did not do the job they were paid to do. Why did they not do their job? Because they had a conflict of interest. The conflict is the age old conflict of interest. Take the money and run, or turn down the business when the requirements for the triple-A rating that the underwriter is looking to receive are not there. Who in America turns down business when it comes knocking? Unfortunately, for the rest of us out there, not involved in the mortgage business, the greed of the rating agencies kept the bubble going for longer than it ever should have lasted. In fact, in my opinion, without the rating agencies compliance, no bubble would have occurred.

The three rating agencies, as they are called, hold a special place in the construction of a mortgage bond. While not a government agency, but as a privately or publicly owned corporation, the rating agency does for bonds what the Food and Drug Administration (FDA) does for drugs. (I will leave food out of this to keep it simple.) When a drug company has a new drug, they take it to the FDA. The FDA tells the drug company to set up a series of tests to prove that the new drug does what it says it is going to do without hurting the individual taking the drug. The point of the tests is to prove efficacy. After the tests are completed the FDA either approves or does not approve the new drug. The rating agencies by giving the triple-A rating to a new batch of mortgage bonds is in essence giving the bond efficacy or at least the good housekeeping seal of approval. Without a bond rating, the task of selling an un-rated mortgage bond issue of several millions of dollars, would be nearly impossible.

At this point, the leaders in Washington need to make a forensic examination of the mortgage bond bubble so they can fully understand where the weakest link in the manufacture of the mortgage bond and the resulting crisis took place. Again, without the rating agencies going along and giving out the triple-A rating on new mortgage bonds, that never should have received their triple-A rating, this housing bubble never gets off the ground.

Wall Street has a choice. Change the way the rating agencies are compensated? Bring on a layer of new Federal regulation to oversee the rating agencies? Remove the rating agency function from the private sector? Or, shoot the head of each rating agency the next time there is a mortgage bubble caused by excessively poor work by the rating agencies? I am kidding about the last suggestion, but some one needs to be held responsible for not doing their job right. We can not expect the SEC to take responsibility for the rating agencies, or can we?

One more thing, and this is of a more technical nature. The rating agencies need to improve the mathematical constructs they use to access risk. This is no easy task. Models are developed based on past information and do not by definition lend themselves to access future probability. In other words, it is difficult to drive a car by looking in the rear view mirror when going forward. That is why tough honest research must be done before the mathematics are applied. If the foundations of the rating process are compromised, the best mathematical constructions will not save the markets from another bubble. Stay tuned.

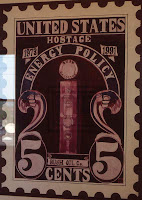

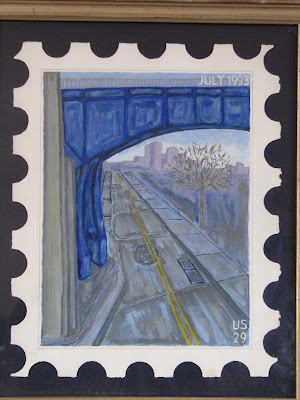

Foot note. The stamp painting was done before 1992 and is titled Federal Home Loan Bank Commemorative. The subject was a previous housing bubble.

Monday, April 28, 2008

A Story to Start the Week

In the Sunday Business section of The New York Times, they are still discussing who is to blame and how and what went wrong in the recent credit meltdown. After I finished reading a couple of articles, I looked over at Chubbs, my cat, sitting in the chair beside me. She had that look on her face that said it all. Yes Chubbs, I wrote about the lack of regulation, the incentives, the greed to take risk, and then take even greater and greater risk, the short fall of the rating agencies to do their job, and how there was not enough shoes on the ground to do the regulatory job right. I did write about all that weeks ago in earlier postings. So, I looked over at Chubbs and told her to first let me reheat my cup of coffee, and then I would tell her a story.

Years ago when I was a young bond portfolio manager/bond trader at Central Trust Bank in downtown Cincinnati, I got to see how decisions at the top were made. Interestingly enough, regardless of how high up the men are that make the decisions, they are always sure to have a scapegoat to take the fall if and when the decision goes bad. That is how things work in organizations that are more than a few people.

I had joined the bank in April, 1977, and took my place in the bank’s bond department where I had access to the munifax wire and all the info that came over the wire daily. In those days, there was the ever present Wall Street Journal and The Blue List of municipal offerings. The Blue List was published daily Monday through Friday and was mailed Special Delivery every day to the various bond departments and broker dealers in the city. These were our tools in 1977. My job was to buy and sell municipal bonds for the trust department and manage a common trust fund of municipal bonds for personal trust clients in the trust department. Although my desk was in the bank’s bond department where the bank’s bond portfolio was managed, I met with members of the trust department’s fixed income committee every few weeks. The chief investment officer of the trust department ran the fixed income committee meetings and set the policy. Furthermore, he had no use for anyone that could enlighten him on the fixed income markets for he received his knowledge from a higher power or perhaps directly from god. The bottom line was that he was dead wrong on the direction of interest rates in 1977 and eventually the trust department paid dearly for his mistakes.

I was young and naive, and thought that with my knowledge of the movement of interest rates, monetary theory and monetary policy as it was being practiced during the Carter administration, that I had a duty to share my knowledge with the trust department. After all, they were paying me $21,000 a year and I had the title of Bond Investment Officer. By November 1977, the “party line” in the trust department was that interest rates were headed lower even though they had been moving higher each month. Each month a man named Joe, who responsible for taxable fixed income would give the standard party line in the trust department's monthly investment meeting. This particular month, I decided that I was going to make a point of enlightening everyone in that big conference room sitting around the huge table, that there was another point of view out there.

When it was my turn to speak about the municipal bond market, I started out by saying I disagreed with everything that Joe had said. That got everyone’s attention, particularly the chief investment officer’s, who wanted his view of the market to be the only view expressed at the meeting. After I finished my presentation on why interest rates were going higher not lower, there was only one person that asked me a question and that was the head of the trust department. He was genuinely interested in my opinion and he knew that the bank’s bond department shared my opinion on the future direction of the yield curve. No one in that entire trust department said a word. I had a short debate for a few minutes with the chief investment officer about where interest rates were headed. Finally I shut up after the CIO said, “what are they (investors) going to do, buy gold?” At that point, I realized that the CIO did not have a clue as to what forces influenced the movement of long term interest rates. I might as well have been speaking Hebrew, he had no idea what factors influenced long term interest rates.

A few months later, in early 1978, the CIO was fired. A large corporate pension fund, with ties to the bank, fired the trust department for the losses it suffered in the bond market. But, in the true fashion of a big organization, the number two man in the trust department was also fired. Before the CIO left the bank, he called me into his office for a talk. I thought he was going to give me a hard time, but he just wanted to ask me some questions about municipal bonds that were so elementary that I could not believe my ears. The question was, “do municipal bond issues have serial maturities?” I could have fallen off my chair. Here was a man who had talked his way into a position that he had no business filling, no wonder he was eventually fired. He was a nice guy who knew how to dress, but he did not have the knowledge to be the CIO of any trust department. I would run into this situation again and again in varying degrees in trust departments in which I would work over the years.

The old story that it is not what you know, but who you know is alive and well. It will never go away. The mistakes, errors, greed and lack of regulation on Wall Street is no different. Letting the large firms regulate themselves is just plain stupid. In Las Vegas where people gamble big stakes, doesn’t the house decide how much can be put on a bet? Of course it does, that’s what risk management is. The gambler doesn’t set house rules, the house sets house rules. The same should apply for Wall Street. If the Fed and the government are going to be the lenders of last resort, are they not the house? And, does it not follow that as the house, they should set house rules for the size and kind of bet. I am not against hedge funds or derivatives, each has a place in managing risk. But, unless there are some house rules, set by the house, we will continue to have meltdowns in the future. Greed is a powerful motivator. A chance to grab the brass ring is too great a temptation to curb reckless behavior. Unless the government gets serious about regulation, oversight and auditing, we will continue to have what is now being referred to as “the privatization of profits and the socialization of losses.” Stay tuned.

Years ago when I was a young bond portfolio manager/bond trader at Central Trust Bank in downtown Cincinnati, I got to see how decisions at the top were made. Interestingly enough, regardless of how high up the men are that make the decisions, they are always sure to have a scapegoat to take the fall if and when the decision goes bad. That is how things work in organizations that are more than a few people.

I had joined the bank in April, 1977, and took my place in the bank’s bond department where I had access to the munifax wire and all the info that came over the wire daily. In those days, there was the ever present Wall Street Journal and The Blue List of municipal offerings. The Blue List was published daily Monday through Friday and was mailed Special Delivery every day to the various bond departments and broker dealers in the city. These were our tools in 1977. My job was to buy and sell municipal bonds for the trust department and manage a common trust fund of municipal bonds for personal trust clients in the trust department. Although my desk was in the bank’s bond department where the bank’s bond portfolio was managed, I met with members of the trust department’s fixed income committee every few weeks. The chief investment officer of the trust department ran the fixed income committee meetings and set the policy. Furthermore, he had no use for anyone that could enlighten him on the fixed income markets for he received his knowledge from a higher power or perhaps directly from god. The bottom line was that he was dead wrong on the direction of interest rates in 1977 and eventually the trust department paid dearly for his mistakes.

I was young and naive, and thought that with my knowledge of the movement of interest rates, monetary theory and monetary policy as it was being practiced during the Carter administration, that I had a duty to share my knowledge with the trust department. After all, they were paying me $21,000 a year and I had the title of Bond Investment Officer. By November 1977, the “party line” in the trust department was that interest rates were headed lower even though they had been moving higher each month. Each month a man named Joe, who responsible for taxable fixed income would give the standard party line in the trust department's monthly investment meeting. This particular month, I decided that I was going to make a point of enlightening everyone in that big conference room sitting around the huge table, that there was another point of view out there.

When it was my turn to speak about the municipal bond market, I started out by saying I disagreed with everything that Joe had said. That got everyone’s attention, particularly the chief investment officer’s, who wanted his view of the market to be the only view expressed at the meeting. After I finished my presentation on why interest rates were going higher not lower, there was only one person that asked me a question and that was the head of the trust department. He was genuinely interested in my opinion and he knew that the bank’s bond department shared my opinion on the future direction of the yield curve. No one in that entire trust department said a word. I had a short debate for a few minutes with the chief investment officer about where interest rates were headed. Finally I shut up after the CIO said, “what are they (investors) going to do, buy gold?” At that point, I realized that the CIO did not have a clue as to what forces influenced the movement of long term interest rates. I might as well have been speaking Hebrew, he had no idea what factors influenced long term interest rates.

A few months later, in early 1978, the CIO was fired. A large corporate pension fund, with ties to the bank, fired the trust department for the losses it suffered in the bond market. But, in the true fashion of a big organization, the number two man in the trust department was also fired. Before the CIO left the bank, he called me into his office for a talk. I thought he was going to give me a hard time, but he just wanted to ask me some questions about municipal bonds that were so elementary that I could not believe my ears. The question was, “do municipal bond issues have serial maturities?” I could have fallen off my chair. Here was a man who had talked his way into a position that he had no business filling, no wonder he was eventually fired. He was a nice guy who knew how to dress, but he did not have the knowledge to be the CIO of any trust department. I would run into this situation again and again in varying degrees in trust departments in which I would work over the years.

The old story that it is not what you know, but who you know is alive and well. It will never go away. The mistakes, errors, greed and lack of regulation on Wall Street is no different. Letting the large firms regulate themselves is just plain stupid. In Las Vegas where people gamble big stakes, doesn’t the house decide how much can be put on a bet? Of course it does, that’s what risk management is. The gambler doesn’t set house rules, the house sets house rules. The same should apply for Wall Street. If the Fed and the government are going to be the lenders of last resort, are they not the house? And, does it not follow that as the house, they should set house rules for the size and kind of bet. I am not against hedge funds or derivatives, each has a place in managing risk. But, unless there are some house rules, set by the house, we will continue to have meltdowns in the future. Greed is a powerful motivator. A chance to grab the brass ring is too great a temptation to curb reckless behavior. Unless the government gets serious about regulation, oversight and auditing, we will continue to have what is now being referred to as “the privatization of profits and the socialization of losses.” Stay tuned.

Saturday, April 26, 2008

Saturday Is For Art

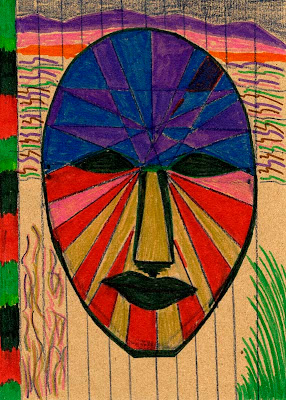

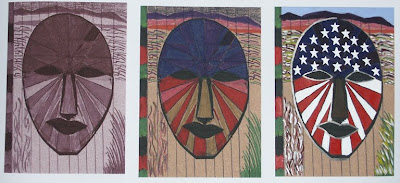

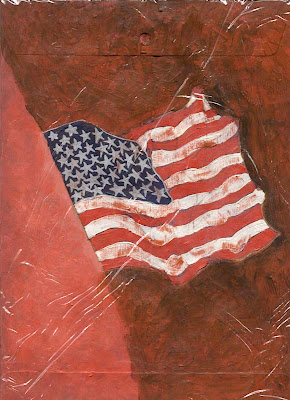

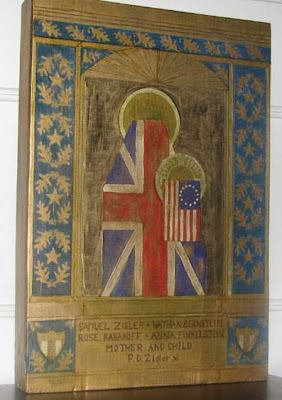

These two paintings are examples of my earliest work, and were completed before the exhibit of my art work at The Carnegie Arts Center. That exhibit opened May 1, 1992 in Covington, Kentucky. The top painting is four feet by four feet square and is on board. I used enamel paint for the flag and the background is oil paint. This piece is titled American Flag Makes the Scene, and is dated 1988-89. The second painting is also painted with enamel and oil paint and measures three feet by four feet, and is dated 1991. The title of this painting is Untitled For Now. I am what is known today as an "outsider artist" because I am not part of a school of art and because I am not a professional artist. Outsider art exists all over the world. Sometimes if the work is primitive in its appearance it is known as "folk art".

Friday, April 25, 2008

First Oil And Now Food

Yesterday the United States was in crisis, today the world is in crisis. First it was oil and now it is food.

Years ago when I was a portfolio manager, economist would talk about "the engine", that the United States was in pulling the economy of the world. Our economy was strong and the rest of the world looked to the United States as the engine behind economic growth for the rest of the world. Then there were two super powers, the United States and the Soviet Union. But, no one thought the Soviets were anywhere near the U.S. as an economic powerhouse. Our system was the model and students came to the United States to study in our universities and observe our society.

As a nation, we could run the table economically. Oil was cheap, gasoline and diesel were cheap, natural gas was very cheap. We had an educated labor pool and capital flowed in to the country. Our financial markets were known around the world by the name Wall Street, and nearly everyone stood in awe of our economic strength. We were on top of the world in so many areas, and most of us enjoyed a great standard of living. Businesses and corporations were run by people, not computers.

But somewhere along the way, things changed. Numbers took over and people and their families became just numbers to the people that studied the numbers, and the bottom line became the only religion in town. Add to this the fact that the political leadership, because of the growth of TV, (a TV in nearly every home), needed to raise larger and larger amounts of money to get elected to office and to get reelected to office. Politicians became perpetual fund raising machines. Business recognized this fact early on as business was in the best position to observe the growth in revenues of corporations that sold air time.

Money, big big money corrupted the political process in the United States. Political success was measured only by winning. A new era was upon us. Since the 1950’s the United States has pissed away, a little each year, its chances to build the country of the future. There are no do overs in this game.

First it was oil and now it is food, the critical events just keep coming one after another. There is no leadership anywhere to be found in sufficient numbers to turn the direction we are headed. One man or woman, even in the highest leadership position, President of the United States, is not enough now to turn the tide, much less make up for opportunities lost.

We are in more than a mild economic decline, the world is watching a super power in decline. While we may think that many may cheer this event, still many fear and realize what this really means. The United States like all nations can not be all things to all people all of the time. Even the United States, the great economic engine of the past, has limits to its strength and resources. The world has good reason to fear the vacuum left by the demise of the world’s truly last and only economic super power. Where and when will that new economic super power emerge?

Advertising is a great thing, but like anything else, it can be abused. Unfortunately, the American people have been fed a steady diet of crap, and now unfortunately they are paying for the poor choices they made. Perhaps it is not too late for us to turn the economy, but also the nation around and point us in a wiser direction. Stay tuned.

Years ago when I was a portfolio manager, economist would talk about "the engine", that the United States was in pulling the economy of the world. Our economy was strong and the rest of the world looked to the United States as the engine behind economic growth for the rest of the world. Then there were two super powers, the United States and the Soviet Union. But, no one thought the Soviets were anywhere near the U.S. as an economic powerhouse. Our system was the model and students came to the United States to study in our universities and observe our society.

As a nation, we could run the table economically. Oil was cheap, gasoline and diesel were cheap, natural gas was very cheap. We had an educated labor pool and capital flowed in to the country. Our financial markets were known around the world by the name Wall Street, and nearly everyone stood in awe of our economic strength. We were on top of the world in so many areas, and most of us enjoyed a great standard of living. Businesses and corporations were run by people, not computers.

But somewhere along the way, things changed. Numbers took over and people and their families became just numbers to the people that studied the numbers, and the bottom line became the only religion in town. Add to this the fact that the political leadership, because of the growth of TV, (a TV in nearly every home), needed to raise larger and larger amounts of money to get elected to office and to get reelected to office. Politicians became perpetual fund raising machines. Business recognized this fact early on as business was in the best position to observe the growth in revenues of corporations that sold air time.

Money, big big money corrupted the political process in the United States. Political success was measured only by winning. A new era was upon us. Since the 1950’s the United States has pissed away, a little each year, its chances to build the country of the future. There are no do overs in this game.

First it was oil and now it is food, the critical events just keep coming one after another. There is no leadership anywhere to be found in sufficient numbers to turn the direction we are headed. One man or woman, even in the highest leadership position, President of the United States, is not enough now to turn the tide, much less make up for opportunities lost.

We are in more than a mild economic decline, the world is watching a super power in decline. While we may think that many may cheer this event, still many fear and realize what this really means. The United States like all nations can not be all things to all people all of the time. Even the United States, the great economic engine of the past, has limits to its strength and resources. The world has good reason to fear the vacuum left by the demise of the world’s truly last and only economic super power. Where and when will that new economic super power emerge?

Advertising is a great thing, but like anything else, it can be abused. Unfortunately, the American people have been fed a steady diet of crap, and now unfortunately they are paying for the poor choices they made. Perhaps it is not too late for us to turn the economy, but also the nation around and point us in a wiser direction. Stay tuned.

Thursday, April 24, 2008

The Hidden Costs To Our Economy

Remember the story about the three little pigs and the big bad wolf? That story is more than a children’s story in my opinion. That story in addition to telling you to build a substantial house, is about the hidden costs to an economy in a complex society. The house built of bricks by the third little piggy could have been a metaphor for building a strong society with support and balance for its people.

There is a mental and emotional health of a nation. Our nation, the United States of America, has been pushing the envelope through the multiple tours of service of our troops in the military with a "war” that has lasted now over five years. The lack of attention paid to the economy and the consequences of the financial strain created by the cost of the "war” in Iraq has lead to the budget deficit and the heavy borrowing by the US Treasury. And, it has resulted in being one factor in the decline in the US dollar in the foreign currency exchange market. Post traumatic stress syndrome is more and more coming into the news, as is the accompanying problems that this brings for not only the soldier, but also his/her family. What costs are these for our society and for how long?

In the domestic economy, the loss of jobs is beginning to take its toll. Costs accelerating for energy and food has put additional pressure on individuals and families as disposable income has almost disappeared from the family budget. Families need to get out of the house and do things as a family. Holed up in a house or apartment with little or no money to spend on the family will present new challenges to the emotional stability of the family unit.

By our own hand, we may have brought ourselves a terror from within that will put a further strain on our limited financial resources. Depending on how long and how severe our economic downturn will be, will determine the extent to which our society is impacted in the areas of these hidden costs. A society under stress and strain because of a faltering economy, can not be a good thing as we move into the summer months.

The failure of our policies may cause us to pay a stiff price for not thinking through our options before we acted. Our over eagerness to resort to a problem with a military solution may not have been the wisest way to go. The costs to us as a nation may be far greater than the lives lost in battle and the lives impaired by wounds, but the very fabric of our society will be affected and made to pay a price. The cost of war is much more than the cost in soldiers and bullets. The home front is now absorbing the cost of our foreign policies too. I hope I am wrong, but I doubt we have reached the brick house yet. Stay tuned.

There is a mental and emotional health of a nation. Our nation, the United States of America, has been pushing the envelope through the multiple tours of service of our troops in the military with a "war” that has lasted now over five years. The lack of attention paid to the economy and the consequences of the financial strain created by the cost of the "war” in Iraq has lead to the budget deficit and the heavy borrowing by the US Treasury. And, it has resulted in being one factor in the decline in the US dollar in the foreign currency exchange market. Post traumatic stress syndrome is more and more coming into the news, as is the accompanying problems that this brings for not only the soldier, but also his/her family. What costs are these for our society and for how long?

In the domestic economy, the loss of jobs is beginning to take its toll. Costs accelerating for energy and food has put additional pressure on individuals and families as disposable income has almost disappeared from the family budget. Families need to get out of the house and do things as a family. Holed up in a house or apartment with little or no money to spend on the family will present new challenges to the emotional stability of the family unit.

By our own hand, we may have brought ourselves a terror from within that will put a further strain on our limited financial resources. Depending on how long and how severe our economic downturn will be, will determine the extent to which our society is impacted in the areas of these hidden costs. A society under stress and strain because of a faltering economy, can not be a good thing as we move into the summer months.

The failure of our policies may cause us to pay a stiff price for not thinking through our options before we acted. Our over eagerness to resort to a problem with a military solution may not have been the wisest way to go. The costs to us as a nation may be far greater than the lives lost in battle and the lives impaired by wounds, but the very fabric of our society will be affected and made to pay a price. The cost of war is much more than the cost in soldiers and bullets. The home front is now absorbing the cost of our foreign policies too. I hope I am wrong, but I doubt we have reached the brick house yet. Stay tuned.

Wednesday, April 23, 2008

Is This Empire In Decline?

Empires rise and fall, we know this from our study of history. The ancient Egyptians had many dynasties and ruled for thousands of years. There were also the Greeks, Persians and Romans, all built societies and empires that rose and then declined. The rising is the easier part to understand, but it is the decline that teaches us the more important lessons.

Can the United States be all things to all peoples and not by its own hand drive itself into decline? Arrogance and foolish behavior can drive any empire into decline, and I think the United States is no exception. The good works that we do as a nation, we would like to think are remembered by the people we help, but I seriously doubt it. Staying in a country too long, like fish, start to smell bad after a while. We should know enough when to leave. Our economy is suffering from our government’s ambitions and over extending itself to the point of being detrimental to our security and our economy. The discussion of our security I will leave to the Generals, they have raised this point numerous times lately in the press and on TV. I have written about the deteriorating effects our policies, at home and abroad, have had on our domestic economy. For those that can afford to pay $4 a gallon for gas, you can stop reading right here. For those of you, like me, that are seeing the price of gas cut deeply into their disposal income, you can continue to read on.

Our economy has been built on cheap energy. Cheap energy is now a thing of the past. We live in a world where everyone wants and needs oil. The days when the United States could influence the price of oil are gone. The government had an opportunity to meet the needs of its people over 30 years ago, but no one cared enough to bring this about. There is a lot of talk about leadership in government, but the bottom line is that nothing was done, and now the American people are suffering. People that need to drive will cut out those consumer non- durables and services that they may be able to live without. For a while and perhaps for a long time, the economy is not going to grow at even a slow pace, if at all. The service sector of the economy that has been the area of growth over the most recent years will see grow slow and in some sectors decline. As the inflation picks up, there will be additional costs to society that are not even being talked about right now. There will be a significant period of time before incomes increase and can absorb the increased cost of energy.

If government spending continues to grow and waste is not removed from the budget, the dollar will continue to decline in world currency markets. We can not fool all of the people all of the time. Investors that buy our US Treasury notes and bonds will demand a premium in the form of higher interest rates which will fall on the tax payers and their children. By trying to be all things to all people, we have increased our national debt and run a budget deficit. What have we achieved? We have weaken the value of the dollar as a result of our debts and have increased the price of all things that we import.

Fear is a powerful motivator and it has been used to control and influence people. But, like anything else that is over used, it becomes meaningless. National security is important to all Americans. Personal security will trump national security when it comes to putting food on the table, clothes on our backs and a roof over our heads. If the electorate is fooled into believing that monsters lay in wait, then another four years will see a continuation of past policies and mistakes. At some point, we either correct the policies that have driven our economy to where it is now, or, it goes even lower. But, there will be a price to be paid. Global investors will make their investment decisions based on the world as they see it, not as we would like them to see it.

As I said at the beginning, understanding how an empire rises is the easy part, analyzing how an empire declines is a little harder, and the test is given first and the lesson afterwards. Stay tuned.

Can the United States be all things to all peoples and not by its own hand drive itself into decline? Arrogance and foolish behavior can drive any empire into decline, and I think the United States is no exception. The good works that we do as a nation, we would like to think are remembered by the people we help, but I seriously doubt it. Staying in a country too long, like fish, start to smell bad after a while. We should know enough when to leave. Our economy is suffering from our government’s ambitions and over extending itself to the point of being detrimental to our security and our economy. The discussion of our security I will leave to the Generals, they have raised this point numerous times lately in the press and on TV. I have written about the deteriorating effects our policies, at home and abroad, have had on our domestic economy. For those that can afford to pay $4 a gallon for gas, you can stop reading right here. For those of you, like me, that are seeing the price of gas cut deeply into their disposal income, you can continue to read on.

Our economy has been built on cheap energy. Cheap energy is now a thing of the past. We live in a world where everyone wants and needs oil. The days when the United States could influence the price of oil are gone. The government had an opportunity to meet the needs of its people over 30 years ago, but no one cared enough to bring this about. There is a lot of talk about leadership in government, but the bottom line is that nothing was done, and now the American people are suffering. People that need to drive will cut out those consumer non- durables and services that they may be able to live without. For a while and perhaps for a long time, the economy is not going to grow at even a slow pace, if at all. The service sector of the economy that has been the area of growth over the most recent years will see grow slow and in some sectors decline. As the inflation picks up, there will be additional costs to society that are not even being talked about right now. There will be a significant period of time before incomes increase and can absorb the increased cost of energy.

If government spending continues to grow and waste is not removed from the budget, the dollar will continue to decline in world currency markets. We can not fool all of the people all of the time. Investors that buy our US Treasury notes and bonds will demand a premium in the form of higher interest rates which will fall on the tax payers and their children. By trying to be all things to all people, we have increased our national debt and run a budget deficit. What have we achieved? We have weaken the value of the dollar as a result of our debts and have increased the price of all things that we import.

Fear is a powerful motivator and it has been used to control and influence people. But, like anything else that is over used, it becomes meaningless. National security is important to all Americans. Personal security will trump national security when it comes to putting food on the table, clothes on our backs and a roof over our heads. If the electorate is fooled into believing that monsters lay in wait, then another four years will see a continuation of past policies and mistakes. At some point, we either correct the policies that have driven our economy to where it is now, or, it goes even lower. But, there will be a price to be paid. Global investors will make their investment decisions based on the world as they see it, not as we would like them to see it.

As I said at the beginning, understanding how an empire rises is the easy part, analyzing how an empire declines is a little harder, and the test is given first and the lesson afterwards. Stay tuned.

Tuesday, April 22, 2008

$118 a Barrel and Climbing

Today the price of oil has been quoted at over $118 a barrel, and the oil analysts are saying that the price will go higher. Some of the increase in price is because of the increase in demand and the other part of the increase is because of the problems arising with the supply. The third aspect of the increase, for us in the United States, involves the decline in the value of the US dollar in the foreign exchange markets. (For an explanation of the decline in the US dollar, see the posting titled Money Money Money Money, dated 4/21.

Several years ago I read in The Wall Street Journal an article about the future demand for oil. In the article, they sighted that when China gets to where they are using as much oil per capita as Mexico, that there would be a crisis in the demand for oil around the world. Today it is common to read about the demand for oil in both China and India. But, they are only two countries. While large in populations and growing their economies at faster rates than the more developed economies of the west, the demand for oil has continued to grow around the world. In the Middle East, new emerging countries with new wealth from oil are expanding their economies as well and using ever more oil to build their infrastructures. So, it is simplistic to lay the problem at the door step of our Asian neighbors. Russia, hardly a small country, is also using more oil in its development since the collapse of the Soviet Union. So I ask, where was the CIA’s intelligence gathering mechanism when it came to scouting out the future demand for oil? Did the best and the brightest miss this global shift in the demand for oil as well? Is not oil of strategic importance? Does not jet fuel, tank fuel and truck fuel come from oil? Or, were we planning to reduce our demand for oil here in the United States? I doubt seriously that anyone would have made such a case in 1973, especially since the Cold War with the Soviet Union was still in force. Then, what is the explanation for this Super Power, the United States of America, missing the future demand for oil so badly and not making contingency plans for our future? Is it some great conspiracy concocted by the oil men in Texas and their political friends in Washington? Or, are we just not as smart and forward thinking as we think we are? The growing demand for oil around the world may be an item that we have little if any control of, but certainly we should have foreseen this coming and increased our supply of oil domestically.

The supply of oil has been effected by a number of events taking place in oil producing countries around the world. From Iraq to Mexico to Nigeria and back to the Middle East, oil production for one reason or another has been interrupted because of fighting or other political considerations. OPEC watches the situation and for now is sitting on its hands and taking no action to increase production. So much for helping Kuwait rid itself of the Iraqi army in the Gulf War of the early 1990’s. And, how much did we spend keeping troops in Saudi Arabia after the Gulf War to protect the Saudi oil fields? It is my opinion that we, the United States government, does not use our resources effectively. We spend a lot of money around the globe and have very little to show for it. Now with the “war” in Iraq, we are spending $12 billion a month. To make matters worse economically, we are borrowing money to pay for this “war”.

That brings us the the third factor that has caused the steep price increase in the price of oil for those of us living in the United States. The fact that oil is priced in dollars around the world does not mean that the price of oil has to go up in dollars as dramatically as it has. What this means is that the traders that buy and sell oil, quote their prices for the bid and asked side of the market for the commodity oil, do it in US dollars. What has made the situation worse for all consumers in the United States is the fact that the value of the dollar has fallen in relationship to other major world currencies. If the dollar had held up in value, there would most likely have been some increase in the price of oil and thus the price of gasoline and diesel, but the increase would not have been as great had the dollar maintained its value. What lead to the decline in the value of the US dollar? Borrowing by the US Treasury to pay for things that the government did not have money to pay for. That along with all the items imported from around the world placed us in the position we now find ourselves today economically. Do not blame the politicians because we elect them, and they are our proxies for the policies that are crafted in Washington. That’s how a democracy works. The only problem that I see is that in the present world, some knowledge of economics is essential for our representatives to keep us out of trouble. Unfortunately, knowledge concerning monetary theory and how our fiscal policies inter acts with the world's economy, is itself a rare commodity. Stay tuned.

Monday, April 21, 2008

Money Money Money Money

Today I would like to talk about money, and the US dollar in particular. I have been reading the newspapers like the rest of you, but I am unhappy with what I have been reading. Let me explain.

Since the US dollar has fallen in value, also known as purchasing power, to other major currencies around the world, a number of business writers are writing about how this is good for business. True, a cheaper dollar makes our products cheaper when they are exported. And, it is true that this helps American businesses sell their products overseas. But, what happens to the American consumer? If you are working for one of these companies that sells their products overseas, you may be able to keep your job. But, I hope they give you a raise so you can afford to buy the items we import such as oil.

Not many people think about monetary policy and fiscal policy, and how these two policies work with each other. Newspaper writers come up with some interesting, but in my opinion, off base explanations as to why the cheaper dollar is good. Now I read that the Fed, who has cut interest rates because of our financial services industry crisis is not helping the US dollar by keeping interest rates low. This too is true, but this is not the whole truth.

Investors around the world would continue to buy our US Treasury debt even if interest rates were low, if they knew that the US dollar was maintaining its purchasing power. The problem does not start with low interest rates on US Treasuries. Low interest rate on US Treasuries means low interest rates all around. Remember corporate bonds and asset-backed bonds sell at a spread of so many basis points to US Treasuries. High interest rates impede economic growth, so what are these writer talking about? Business projects get postponed when interest rates are too high and the internal rate of return is not a high enough number to justify the investment in new plant and equipment.

So, where does it all start you may ask. It starts with a sound currency. Monetary policy in this country is not run for the benefit of the consumer, but rather for the benefit of commerce. What is wrong with that? We need to have a growth rate in the money supply to permit reasonable economic expansion. So, what comes first, the chicken or the egg?

I say the egg comes first. And this is my thinking. The US dollar and its integrity is what is paramount in my mind if I am running monetary policy because my populist instincts come down on the side of the individual and the family and their struggle to survive in a complex economy where the large corporation has the advantage.

So, you want to know who is the bad guy in this movie. Take a guess. There are three parts to the economy. The corporate, the consumer and the government. The government spends a lot of money on many many things. All kinds of government programs, some good and some quite wasteful. But it is the spending that exceeds the budget that causes so many problems. I can understand those that want a smaller government, but that is not the whole answer. A smart government knows how to filter out waste and not get bogged down in projects it can not afford or win.

I do not want to get too political because I want my readers to think about economics and see the relationship that political decisions and fiscal policies have on the economy. If you believe that spending $12 billion a month to pursue our policies in Iraq is the right thing to do, there is nothing I can say. Spending more money than the government is taking in requires for the government to borrow. And it is the borrowing and the importing that cause the US dollar to lose purchasing power and fall in value in relation to other major world currencies.

A monetary system that allows the printing of paper money requires discipline. The discipline will come one way or the other. Either the government exerts the discipline and grows the money supply at a reasonable rate for economic growth or there will be discipline exerted outside of government. When foreign investors do not want to hold huge reserves of the US dollar, they exchange them for other currencies. This is no more than supply and demand. Markets are constantly in motion. Prices change as supplies go up and down, and demand goes up and down. If the supply of dollars exceeds the demand for dollars, the price of the dollar in foreign currency terms falls. If there is a trend, the price of the dollar will continue to fall. Borrowing is just a piece of the equation. Importing oil is a piece of the equation. Importing products from China and other nations around the world that manufacturer cheaper than we do at home is a piece of the equation. When you add up all these pieces to the equation, you get a dollar that is cheaper for foreign buyers of dollars and an inflationary effect for the American consumer who must use dollars for their purchases.

What should become clear is that the currency markets and the laws of supply and demand will trump what the United States government does with its own fiscal and monetary policies. The investors outside the United States sees what is happening to the dollar on the currency exchange markets and acts. That is why the dollar is valued where it is at present. If the United States government made a change in its fiscal policy and borrowed less and imported less, there would be a corresponding change in the currency market’s psychology as it relates to the US dollar.

We need to have business writers from the newspapers to understand how currencies operate in the market and what causes money to go up and down in value. And, while we are at it, the same would be good for the politicians to understand this as well. Stay tuned.

Since the US dollar has fallen in value, also known as purchasing power, to other major currencies around the world, a number of business writers are writing about how this is good for business. True, a cheaper dollar makes our products cheaper when they are exported. And, it is true that this helps American businesses sell their products overseas. But, what happens to the American consumer? If you are working for one of these companies that sells their products overseas, you may be able to keep your job. But, I hope they give you a raise so you can afford to buy the items we import such as oil.

Not many people think about monetary policy and fiscal policy, and how these two policies work with each other. Newspaper writers come up with some interesting, but in my opinion, off base explanations as to why the cheaper dollar is good. Now I read that the Fed, who has cut interest rates because of our financial services industry crisis is not helping the US dollar by keeping interest rates low. This too is true, but this is not the whole truth.

Investors around the world would continue to buy our US Treasury debt even if interest rates were low, if they knew that the US dollar was maintaining its purchasing power. The problem does not start with low interest rates on US Treasuries. Low interest rate on US Treasuries means low interest rates all around. Remember corporate bonds and asset-backed bonds sell at a spread of so many basis points to US Treasuries. High interest rates impede economic growth, so what are these writer talking about? Business projects get postponed when interest rates are too high and the internal rate of return is not a high enough number to justify the investment in new plant and equipment.

So, where does it all start you may ask. It starts with a sound currency. Monetary policy in this country is not run for the benefit of the consumer, but rather for the benefit of commerce. What is wrong with that? We need to have a growth rate in the money supply to permit reasonable economic expansion. So, what comes first, the chicken or the egg?

I say the egg comes first. And this is my thinking. The US dollar and its integrity is what is paramount in my mind if I am running monetary policy because my populist instincts come down on the side of the individual and the family and their struggle to survive in a complex economy where the large corporation has the advantage.

So, you want to know who is the bad guy in this movie. Take a guess. There are three parts to the economy. The corporate, the consumer and the government. The government spends a lot of money on many many things. All kinds of government programs, some good and some quite wasteful. But it is the spending that exceeds the budget that causes so many problems. I can understand those that want a smaller government, but that is not the whole answer. A smart government knows how to filter out waste and not get bogged down in projects it can not afford or win.

I do not want to get too political because I want my readers to think about economics and see the relationship that political decisions and fiscal policies have on the economy. If you believe that spending $12 billion a month to pursue our policies in Iraq is the right thing to do, there is nothing I can say. Spending more money than the government is taking in requires for the government to borrow. And it is the borrowing and the importing that cause the US dollar to lose purchasing power and fall in value in relation to other major world currencies.

A monetary system that allows the printing of paper money requires discipline. The discipline will come one way or the other. Either the government exerts the discipline and grows the money supply at a reasonable rate for economic growth or there will be discipline exerted outside of government. When foreign investors do not want to hold huge reserves of the US dollar, they exchange them for other currencies. This is no more than supply and demand. Markets are constantly in motion. Prices change as supplies go up and down, and demand goes up and down. If the supply of dollars exceeds the demand for dollars, the price of the dollar in foreign currency terms falls. If there is a trend, the price of the dollar will continue to fall. Borrowing is just a piece of the equation. Importing oil is a piece of the equation. Importing products from China and other nations around the world that manufacturer cheaper than we do at home is a piece of the equation. When you add up all these pieces to the equation, you get a dollar that is cheaper for foreign buyers of dollars and an inflationary effect for the American consumer who must use dollars for their purchases.

What should become clear is that the currency markets and the laws of supply and demand will trump what the United States government does with its own fiscal and monetary policies. The investors outside the United States sees what is happening to the dollar on the currency exchange markets and acts. That is why the dollar is valued where it is at present. If the United States government made a change in its fiscal policy and borrowed less and imported less, there would be a corresponding change in the currency market’s psychology as it relates to the US dollar.

We need to have business writers from the newspapers to understand how currencies operate in the market and what causes money to go up and down in value. And, while we are at it, the same would be good for the politicians to understand this as well. Stay tuned.

Saturday, April 19, 2008

Saturday is for Art

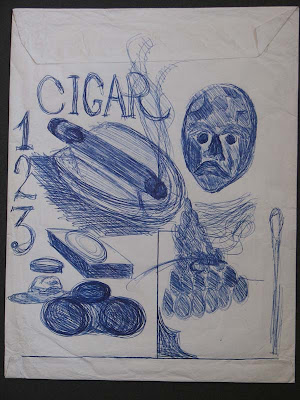

The piece today is a drawing I call My Icons. The drawing was started in 2004 and then later finished three years later in 2007. The shape comes from the shape of the window that it is framed in. When I worked in Columbus, Ohio, I had an apartment that I lived in during the week. The new owner of the apartment building decided to replace the old wood windows that did not work. I salvaged a few of the odd shaped windows as I like to put my drawings in old wood windows. I think old wood windows make interesting frames. Windows permit us to see out and in. So, I just feel windows make what I would call a "natural frame." In this drawing there is "the level playing field", mother and child, a butterfly, the electric outlet and switch, all against an old Roman fountain. If anyone is interested in buying a copy of this drawing, feel free to contact me.

Friday, April 18, 2008

In Philadelphia, 2008

Friday morning and I find myself in downtown Philadelphia only a few blocks from where it all happened at Independence Hall. While these men did not have cars to drive, TVs to watch or the Internet to communicate on, they were very much like us today. They felt oppressed by a government that was insensitive to their needs and aspirations for a better life for themselves and their families. The men that wrote the laws were a long distance away in physical terms, where as today the men that write the laws are a long distance away in mental terms. The leaders proclaim a sensitivity to the plight of the “Middle Class” (I feel your pain), but year after year a significant portion the middle class is duped into believing that issues like abortion, gay marriage and stem cell research is what is important in America today. Well this November, we will see what is important and to whom.

The Founding Fathers of this country knew they had a majority of the people behind them and that fact gave them the courage to go forward and revolt from mother England. Not all of those that lived in the 13 colonies were of the same mind. A sizable group wanted to remain loyal to the king and remain good subjects of the crown. But the king and his advisers were out of touch. Economically, it became necessary for the child, who was now no longer a child to cut the cord, to move in a new direction. That made the Declaration of Independence and the Revolutionary War a necessity. Today, many people feel that the leadership in Washington is too far away and insensitive to the needs, hopes and aspirations of the people. Again, this November we will see what the people think.

My money is on change, and not the kind in your pocket. It is time to put a president in office that is from the middle class. Someone that knows first hand what it means to live and work and raise a family in the America of today and not the 18th century. We can be a strong, independent and well educated nation, but the leaders have been listening to the men that would keep the middle class down and moving most of us in the direction of lower and poorer economically. We have the resources and the brain power to free ourselves from the dependence of foreign oil, just as we had the courage to free ourselves from an insensitive king.

History presents new challenges to each generation. The challenge for us today is to get control of our dependency on foreign oil and to slow the decline in the value of the dollar. Both of these issues are tied to each other. Oil and trade policies are not working for the middle class. Take a look around, it does not take an Einstein to see what is happening. As a nation we are moving in the wrong direction. For those that know on what side their bread is buttered, I have no illusions, but for those of you out there that may soon not have the money to buy the bread to put the butter on, I hope you will join me in November and vote for a change. King George's time is past, a new fresh intelligent leader is needed now to clean up the mess and get the middle class back on track. Stay tuned.

Thursday, April 17, 2008

Brain Dead

Oil prices are hitting new highs as is gasoline, and no relief is in sight. I wonder at what price if any will the government take some action. Will people continue to drive at their present rate, or will the price of gasoline begin to cause more drivers to think before they turn on their engines. Either way, with gasoline quickly approaching $4.00 per gallon for a national average, something in family budgets has to give. Food prices have also been affected by the increase in gasoline prices as well as the fact that grain prices have risen this past year because of the production of ethanol. The price of flour has doubled. Perhaps more Americans will start growing their own food, or at least start planting more vegetable gardens. What happens to retail sales when people do not shop because their disposable income is going into filling up their gas tank. If you have a job and the only way to get to work is to drive, there is no option, money must be spent on gasoline. But after paying for food and shelter, little disposal income will be left for much else. What happens to all those retail stores and all those shopping malls? Will, or can, the consumer continue to add to personal (credit card) debt? It is obvious that these gasoline prices are not affecting the leaders in Washington. With incomes over $100,000 per year, they are perhaps not even aware that the increases in gasoline and diesel prices are having on the average American family. At what point do we have a national emergency? I guess as long as our leaders in Washington can continue to live their lives without any inconvenience, then the rest of us should be happy to watch TV, drink beer and sit at home in the dark. I can only imagine what the mood of the electorate will be come November 2008?

This is a special weekend for me, so I may not post anything on Friday April 18. Take a moment and reflect on some of the commentary from past postings. Perhaps, even go back and read a few on oil. This problem is not going away anytime soon. This economy is not headed in the right direction until some action is taken to bring relief to the price of gasoline and diesel. Gradual change in prices can be better handled than rapid price increases. The economic dislocations that are happening as a result of the sudden and large percentage increases are hitting the economy right now. Those of us that live in urban areas can get out our walking shoes and walk to the store. Those that must drive better car pool more. The weather is getting warmer and walking will be in vogue, so turn off your engines and get your legs in shape. Stay tuned.

This is a special weekend for me, so I may not post anything on Friday April 18. Take a moment and reflect on some of the commentary from past postings. Perhaps, even go back and read a few on oil. This problem is not going away anytime soon. This economy is not headed in the right direction until some action is taken to bring relief to the price of gasoline and diesel. Gradual change in prices can be better handled than rapid price increases. The economic dislocations that are happening as a result of the sudden and large percentage increases are hitting the economy right now. Those of us that live in urban areas can get out our walking shoes and walk to the store. Those that must drive better car pool more. The weather is getting warmer and walking will be in vogue, so turn off your engines and get your legs in shape. Stay tuned.

Wednesday, April 16, 2008

Best Practices? What Does That Mean?

Best practices? What does that mean? Yesterday there was a business story about new regulations regarding hedge funds. The article stated that there are about 8,000 hedge funds and about $2 trillion invested in hedge funds. Hedge funds are usually invested in by large pools of money like state pension funds. The idea behind investing in a hedge fund for say a large state employee pension fund is to manage the risk the total fund has through its exposure to the securities markets. This is usually referred to as risk management. In a regularly managed portfolio of bonds or stocks, the portfolio manager buys those securities it wants to hold and sells those securities it believes will not outperform the market. Why would a portfolio hold onto a stock if the manager believed that it was not going to out perform the market (that market’s index)? Portfolio managers that manage a portfolio of equities, hold those equities that they believe will outperform the market.

In a hedge fund, the portfolio manager or portfolio management team can decide to buy equities, or, they can decide to sell short those equities they believe will under perform the market. In other words, a hedge fund can make money for its client in both a bull or bear market. To sell short, the portfolio manager borrows the stock from someone that is long the stock and then sells it. When the stock goes down in price, the portfolio manager buys the stock back and returns it to the broker they borrowed it from. The difference between the price they sold the stock and bought it back is there profit less the expenses of doing the trade.

What I find so interesting about this article about new hedge fund regulations is the comment by the attorney general from the State of Connecticut. He called the “best practices” statement a “virtual farce.” That is pretty strong language for a state’s attorney general. Perhaps he has political aspirations too. Nevertheless, such a statement does cause one to stop and ask oneself, what does "best practices” really mean?

Senator Schumer, (D-NY) made a comment that in the interm, these “best practices” should strengthen the hedge fund industry and provide regulators and investors with better information. Spoken like a true politician from the state where Wall Street resides.

The “best practices” is suppose to increase the transparency and risk management for the investor and the hedge fund. The treasury secretary said it would. What I don’t know is whether the “best practices” is strictly voluntary or whether there are specific requirements concerning reporting?

Naturally the first defense against any new regulation that is rolled out is the fear defense. Improvements are welcome as long as they do not keep the US financial markets from being competitive in a global economy. If our house of cards falls down, who in the global economy is going to help us put it back up?

You know what this whole thing reminds me off? Letting the foxes draw up the specs for the construction of the chicken coop. Why not? At some point people have to wake up to the fact that unless we get serious about regulation, oversight and auditing, we are going to be visiting a financial crisis event ever few years. How can that track record make us more competitive in the global economy?

You know there is always a lot of talk about the fact that Americans do not save money. That American families live with too much debt. This is all probably true, but has anyone ever tried to see the relationship between not saving money and racking up debt? If our monetary policy paid as much attention to the integrity of the dollar, also known as protecting against its decline in purchasing power, then perhaps people would have an incentive to save money. But this is not the case. Monetary policy has for many years been run for the benefit of commerce, not the benefit of the consumer and the saver. With a currency that is losing purchasing power every year, the need to stay even or ahead of inflation causes the need to take greater risks when investing. Greater risks sometimes means greater profits, but not always. Today we find the financial services industry involved in a number of more risky investments while the money managers try to hold onto their bigger clients, who continue to put more pressure on the money manager for better investment performance.

Yesterday, the price of a barrel of oil reached a new high of over $114, and the US dollar continues to decline in value. It you think this whole things is starting to resemble the dog chasing its own tail, you probably have a pretty good handle on what is happening. Stay tuned.

In a hedge fund, the portfolio manager or portfolio management team can decide to buy equities, or, they can decide to sell short those equities they believe will under perform the market. In other words, a hedge fund can make money for its client in both a bull or bear market. To sell short, the portfolio manager borrows the stock from someone that is long the stock and then sells it. When the stock goes down in price, the portfolio manager buys the stock back and returns it to the broker they borrowed it from. The difference between the price they sold the stock and bought it back is there profit less the expenses of doing the trade.

What I find so interesting about this article about new hedge fund regulations is the comment by the attorney general from the State of Connecticut. He called the “best practices” statement a “virtual farce.” That is pretty strong language for a state’s attorney general. Perhaps he has political aspirations too. Nevertheless, such a statement does cause one to stop and ask oneself, what does "best practices” really mean?

Senator Schumer, (D-NY) made a comment that in the interm, these “best practices” should strengthen the hedge fund industry and provide regulators and investors with better information. Spoken like a true politician from the state where Wall Street resides.

The “best practices” is suppose to increase the transparency and risk management for the investor and the hedge fund. The treasury secretary said it would. What I don’t know is whether the “best practices” is strictly voluntary or whether there are specific requirements concerning reporting?

Naturally the first defense against any new regulation that is rolled out is the fear defense. Improvements are welcome as long as they do not keep the US financial markets from being competitive in a global economy. If our house of cards falls down, who in the global economy is going to help us put it back up?

You know what this whole thing reminds me off? Letting the foxes draw up the specs for the construction of the chicken coop. Why not? At some point people have to wake up to the fact that unless we get serious about regulation, oversight and auditing, we are going to be visiting a financial crisis event ever few years. How can that track record make us more competitive in the global economy?

You know there is always a lot of talk about the fact that Americans do not save money. That American families live with too much debt. This is all probably true, but has anyone ever tried to see the relationship between not saving money and racking up debt? If our monetary policy paid as much attention to the integrity of the dollar, also known as protecting against its decline in purchasing power, then perhaps people would have an incentive to save money. But this is not the case. Monetary policy has for many years been run for the benefit of commerce, not the benefit of the consumer and the saver. With a currency that is losing purchasing power every year, the need to stay even or ahead of inflation causes the need to take greater risks when investing. Greater risks sometimes means greater profits, but not always. Today we find the financial services industry involved in a number of more risky investments while the money managers try to hold onto their bigger clients, who continue to put more pressure on the money manager for better investment performance.

Yesterday, the price of a barrel of oil reached a new high of over $114, and the US dollar continues to decline in value. It you think this whole things is starting to resemble the dog chasing its own tail, you probably have a pretty good handle on what is happening. Stay tuned.

Tuesday, April 15, 2008

Regulation, Oversight and Auditing Badly Needed

Today is April 15 and I hope everyone has remembered what day it is. You have until midnight to file your tax return unless you are getting an extension.

Today is also the 61st anniversary of Jackie Robinson breaking into Major League Baseball. For those of you who may not know the history of race and Major League Baseball, before April 15, 1947, there were no African-Americans or other men of color playing in the Major Leagues. Today, 61 years later, men of color from all over the world play baseball and other professional sports in America today. This year, a presidential election year, there is an African-American man (and a white woman) running to be their party’s candidate for the presidency. While no society is perfect, things have changed over the last 61 years. Perhaps not fast enough to suit all of us, but as someone who has read a little history over my 65 years, on a historical basis change is taking place very fast in America today. TV, the Internet and newspapers can lead the way if they have the desire and talent to educate and inform.

The Sunday Business Section of the New York Times was filled with business articles about the failure of regulations, oversight and auditing that lead up to the present financial service industry crisis. After the train wreck in the financial services industry, everyone now has an opinion and a few have even taken the effort to start digging into the details of how business was conducted that brought about the mess. Those, like myself, that offer an opinion are OK in my book, but the real praise should go to those reporters that dig and write detailed accounts of where and when the wheels first started to come off. For them I have a great deal of respect, especially when they get it right because this stuff is more than a few rungs up the ladder for its degree of difficulty.

To analyze the mortgage train wreck, the writers go back to the point before the train left the station. Big mistakes were made right from the get go. People knew that corners were being cut and the proper reserves were not being held back for mortgages that would not meet the test for securitization. Yet, they went a head any way and continued the practice until bankruptcy was the only avenue left for management to take.

Back in the mid-1970’s, I had the opportunity to work with a very bright and nice man. His name was Joe Hutton, and he was my boss and the head of the investment division of the trust department at the Provident Bank. I remember him explaining to me the importance of keeping files on the stocks we used in the trust account portfolios. You need to have a file and show that you tried to bring your research and intelligence to bare even if you lost money on a stock, he said. Why? I asked. Because, he said, they can fault you for not doing the research and keeping the file, but they can not fault you for being stupid.

The mortgage meltdown was not so much a matter as being stupid as being greedy.

I once had a brief discussion a few years back with a man a little older, who was a broker for many years in Cleveland, about greed. We were discussing the events that lead to some one that was convicted of “cherry picking stocks” and sent to prison for doing that to pension funds under his management. I said, this particular person was too greedy. His response to me was that there is no such thing as “too greedy.” I disagree. There are a lot of greedy people in the financial services industry. Some stay within the law, while others do not. Those that find it necessary to break the law, in my opinion, are too greedy.